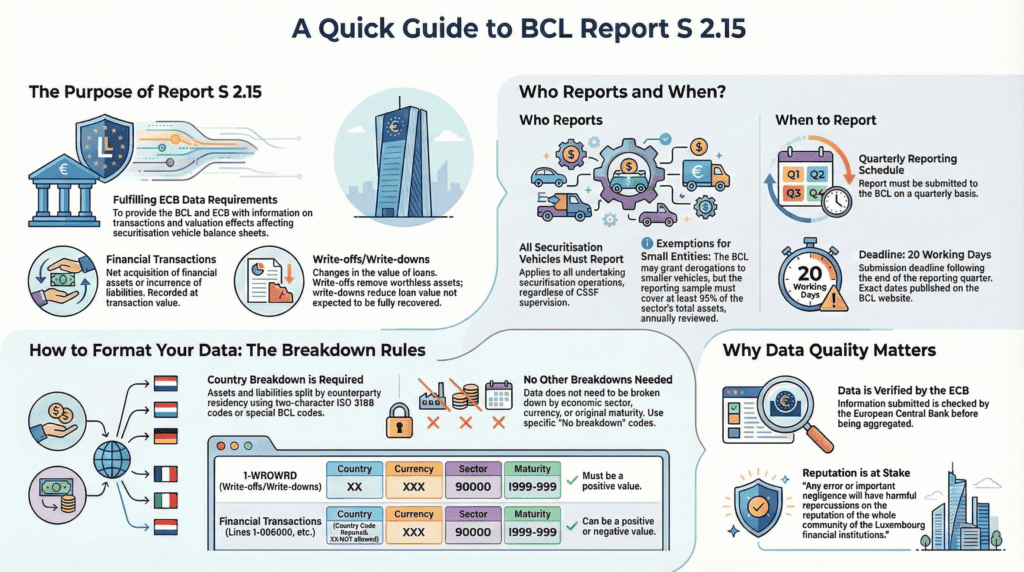

This briefing details the requirements for Report S 2.15, “Transactions and write-offs/write-downs on securitised loans of securitisation vehicles,” a mandatory quarterly submission to the Banque centrale du Luxembourg (BCL). The report’s primary objective is to furnish the European Central Bank (ECB) with critical data on financial transactions and valuation changes within securitisation vehicles (SVs) for its analytical and research needs.

Reporting is mandatory for a BCL-defined sample of SVs, which collectively represent at least 95% of the sector’s total assets in Luxembourg. Submissions are due within 20 working days of the quarter-end. The BCL places extreme emphasis on data quality, warning that “Any error or important negligence will have harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.” The regulation stipulates highly specific verification rules and coding for data breakdowns, making rigorous internal controls essential for compliance. Failure to adhere to these complex rules can lead to reporting errors and regulatory scrutiny.

1. What Is Report S 2.15 and Why Is It Required?

Report S 2.15 is a statistical data collection instrument mandated by the BCL under the authority of ECB Regulation (EU) No 1075/2013 (ECB/2013/40). Its sole purpose is to gather granular data on two specific types of activities within SVs during a reporting period:

- Financial Transactions: Net acquisitions of financial assets and net incurrence of liabilities for specific balance sheet items.

- Valuation Effects: Specifically, the write-offs and write-downs applied to securitised loans.

The BCL aggregates this data for transmission to the ECB, contributing to the broader Eurosystem’s understanding of developments in securitisation markets.

2. Who Must Report, How Often, and by When?

2.1. Reporting Population

- Applicability: The regulation applies to all securitisation vehicles, irrespective of their legal status or whether they are supervised by the Commission de Surveillance du Secteur Financier (CSSF).

- Exemptions: The ECB regulation allows for exemptions for smaller entities. The BCL implements this by establishing a sample of reporting agents.

- Selection Criteria: The BCL selects the sample to ensure that the reporting vehicles account for at least 95% of the total assets of all SVs in Luxembourg. This sample is reviewed and revised on a yearly basis.

2.2. How Frequently Must Report S 2.15 Be Submitted and What Are the Deadlines?

- Frequency: Report S 2.15 must be submitted on a quarterly basis.

- Deadline: The submission deadline is no later than 20 working days following the end of the quarter to which the data relates. The BCL publishes a schedule of exact reporting dates on its official website.

3. What Are the Core Data Concepts Used in Report S 2.15?

3.1. Financial Transactions

A financial transaction is defined as the net acquisition of financial assets or the net incurrence of liabilities. It represents the sum of all transactions during the period, recorded at their actual transaction value. Critically, the BCL explicitly states that valuation changes, including write-offs and write-downs, do not constitute financial transactions.

Reporting on financial transactions is required only for the following specific balance sheet items:

- 1-006000: Non-financial assets

- 1-007000: Financial derivatives (Assets)

- 1-011020, 1-011040, 1-011090: Other securitised assets

- 2-011000: Financial derivatives (Liabilities)

A materiality threshold applies: reporting on valuation effects for these items is mandatory only if the amount reported for an item exceeds 5% of the vehicle’s total assets. Reporting below this threshold is optional.

3.2. What Are Write-offs and Write-downs?

Data on write-offs/write-downs is collected to capture the impact of value changes on securitised loans recorded at nominal value on the balance sheet (items 1-010010 to 1-010060). This information is reported under a single, dedicated line item: 1-WROWRD.

- Write-offs: Occur when a loan is deemed a worthless asset and is consequently removed from the balance sheet.

- Write-downs: Occur when a loan is not expected to be fully recovered, and its value is reduced on the balance sheet.

4. What Data Breakdowns and Verification Rules Must Be Applied?

The BCL has established a “Compendium of verification rules” to ensure data integrity. These rules are classified as permanent, and software providers are expected to implement them. For Report S 2.15, adherence to specific coding for data breakdowns is not optional.

4.1. General Breakdown Requirements

- Country: Mandatory Breakdown. Assets and liabilities must be disaggregated by the counterparty’s country of residency, using two-character ISO 3166 codes. Special codes are designated for European and international institutions (e.g., XA for ECB, XE for EIB). The code XX (“No breakdown”) is only permitted where explicitly allowed.

- Currency: No Breakdown Required. All amounts must be reported as a total using the currency code XXX.

- Economic Sector: No Breakdown Required. All amounts must be reported as a total using the economic sector code 90000.

- Original Maturity: No Breakdown Required. All amounts must be reported as a total using the original maturity code I999-999.

4.2. Internal Verification Rules for Specific Line Items

| Line Item(s) | Required Breakdown | Country Code Rule | Currency Code | Sector Code | Maturity Code | Amount Rule |

|---|---|---|---|---|---|---|

| 1-WROWRD (Write-offs/Write-downs) | None | Must be XX | XXX | 90000 | I999-999 | Must be positive |

| 1-006000, 1-007000, 1-011020, 1-011040, 1-011090, 2-011000 | Country Only | May NOT be XX | XXX | 90000 | I999-999 | Can be positive or negative |

5. How Can Compliance Challenges Be Addressed with Fund XP?

The complexity of the S 2.15 reporting framework—from data sourcing and classification to the application of rigid verification rules and coding standards—presents significant operational challenges. The explicit warning from the BCL regarding the reputational risk of errors underscores the need for a robust, automated solution.

The Fund XP solution is engineered to directly address these challenges and mitigate compliance risk:

- Automated Rule Implementation: Fund XP embeds the BCL’s permanent verification rules directly into the reporting workflow. This allows for the pre-validation of data, ensuring that submissions are compliant with specific coding requirements (e.g., correct use of XX vs. ISO codes, XXX, 90000) before the report is generated.

- Data Aggregation and Formatting: The platform automates the aggregation of transactional data and correctly formats it according to the required breakdowns, significantly reducing the manual effort and potential for human error associated with classifying data by country.

- Streamlined XML Generation: By automating the creation of the final submission file, as indicated by the “Import XML,” “Export XML,” and “XML Filing” functions in the reporting template, Fund XP ensures that securitisation vehicles can meet the tight 20-working-day deadline reliably.

- Risk Mitigation: By enforcing data quality and adherence to BCL standards, the solution helps safeguard the reporting entity’s reputation and minimizes the risk of regulatory penalties or inquiries stemming from inaccurate or non-compliant submissions.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Vehicules_de_titrisation/Instructions/S0215/index.html