Financial Companies:

Securitization Vehicules:

Investment Funds:

Table of Contents

Features

BCL S and TPT Excel templates

-

ACCURACY

Robust controls are in place to prevent errors or omissions.

-

USER FRIENDLY

The solution is easy for users to understand and use, with clear instructions and intuitive interfaces.

-

XML

Easily import and export BCL reports in XML format with the proper naming convetion.

-

FILING

Optionally, we can do the secure filing to the authorities and the feedback fellowship. (No E-file SOFiE or Luxtrust needed)

-

SUPPORT

Free, adequate support and helpdesk.

What is BCL reporting?

The Luxembourg Central Bank (BCL) is responsible for collecting monetary and financial statistical data from banking and financial institutions, such as banks, investment funds and insurance companies.

The statistical BCL report aims to provide the BCL with a comprehensive overview of Luxembourg’s financial system and support the development of macroeconomic statistics for the country.

Security by security reporting, on the other hand, refers the reporting of detailed information on individual securities held by financial institutions. This includes data on the issuer, type of security, maturity, interest rate, and other relevant characteristics.

BCL reports are mandatory requirements for financial institutions operating in Luxembourg. The BCL uses the data collected through these reporting requirements to monitor the health and stability of the financial system, assess risks and vulnerabilities, and make informed decisions about monetary policy.

What is the frequency of the financial companies’ reports?

The last day of each quarter should be the reference date for the establishment of the quarterly statistical reports :

- S2.16 «Quarterly statistical balance sheet of financial companies »

- S2.17 «Quarterly information on all transactions of financial companies ».

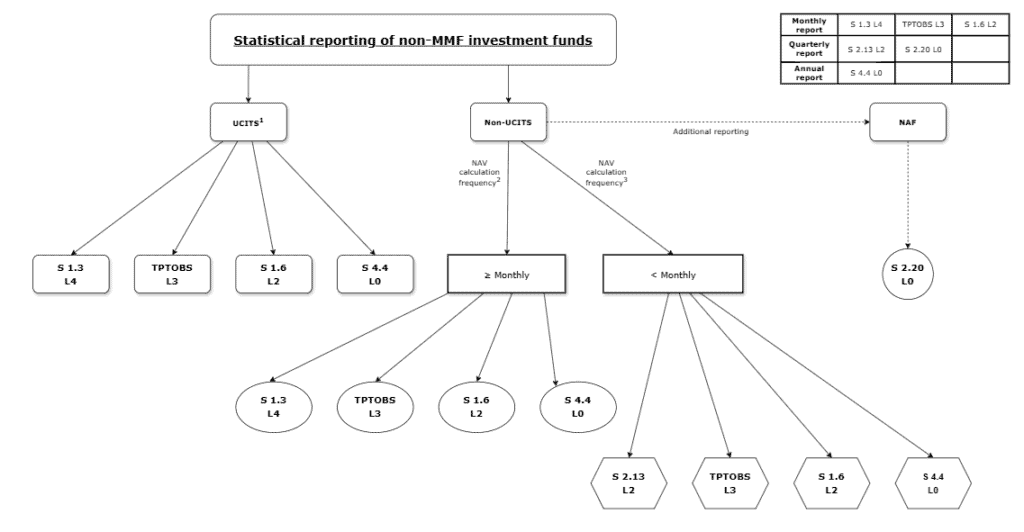

- S1.3 & S2.13 «Statistical balance sheet for investment funds»

- S1.6 «Information on valuation effects on the balance sheet for non-monetary investment funds»

- S2.14 «Quarterly statistical balance sheet of securitisation vehicles»

- S2.15 «Transactions and write-offs/write-downs on securitised loans of securitisation vehicles»

- S2.18 «Quarterly statistical balance sheet of insurance corporations – Luxembourg entity»

- S2.19-L «Information on valuation effects on the balance sheet of insurance corporations – Luxembourg entity»

- S4.3-L «Annual Premiums, claims and commissions of insurance corporations – Luxembourg entity»

- S 2.20 «Quarterly financial information», the deadlines are based on the working days defined by the ECB. 30/01/2026, 04/05/2026, 28/07/2026, 28/10/2026, 01/02/2027

- S 4.4 «Marketing countries», is a yearly reporting. 08/04/2026 – 08/04/2027

The last day of each month should be the reference date for establishing the monthly security by security (TPTIBS, TPTOBS, TPTASS, TPTTBS) reports.

What is the threshold for BCL reporting?

The BCL foresees a threshold on exemption based on total balance sheet. Currently, the threshold amount is fixed to 500 million Euros or the equivalent amount in foreign currency.

Which financial companies should be reported?

A reportable financial company is every company whose object contains at least one of these factors detailed below:

- The investment in any society for any kind of investment.

- The acquisition by subscription, purchase, exchange or any other way of securities, shares and other equity investments, bonds, receivables, certificates of deposits and other debt instruments and generally all financial instruments issued by a public or private entity.

- To invest directly or indirectly in the acquisition and management of a real estate portfolio, of patents or other intellectual property rights, whatever the nature or the origin.

- To borrow in any form

- To lend funds to his shareholders, subsidiaries, affiliated companies, and/or any other entity.

Which funds should be reported?

- The undertakings for collective investment (UCI) governed by the law of 17 December 2010.

- The specialised investment funds (SIF) governed by the law of 13 February 2007.

- The investment companies in capital risk (SICAR) governed by the law of 15 June 2004.

- The Luxembourg’s non-regulated alternative investment funds, managed by a Luxembourg or foreign alternative investment funds manager, fulfil the criteria of article 1(39) of the law of 12 July 2013 and that are not exempted from the BCL reporting.

External links:

- Investment funds

- BCL circular 2014/237

- BCL circular 2018/241

- BCL Definitions and concepts

- Types of breakdown

- S1.3 S2.13 manual

- S1.6 manual

- S2.20 Quaterly Financial Information – New starting 2026!

- S4.4 Marketing Countries – New starting 2026!

- TPTOBS manual – New Layout starting 2026!

- FAQ

- Electronic transmission manual