Ensuring compliance with the AIFMD Annex IV reporting requirements is critical. This is particularly important for alternative investment fund managers (AIFMs).

Our AIFMD Annex IV reporting solution provides a robust, secure, and fully automated platform. It is designed to meet the stringent regulatory standards set by the European Securities and Markets Authority (ESMA). These standards are also in line with those set by local authorities.

The platform automates the entire Annex IV reporting process, from data collection and validation to submission, ensuring compliance with all relevant regulations.

We generate more than 2000 reports per year and perform over 800 checks. This ensures high-quality know-how and the correctness of our reports.

Our AIFMD reporting platform build reports using complete automatic processes and automated validation checks (Local authority & ESMA). We stay current with the latest specifications, ensuring that our software reflects any changes or updates. Our reports are always compliant with the current regulatory standards.

Optionally, we can act as a technical sender and do the filing to the authorities. (free filing using the CSSF S3 for Luxembourg)

AIFMD Templates

-

SCALABLE SOLUTIONS

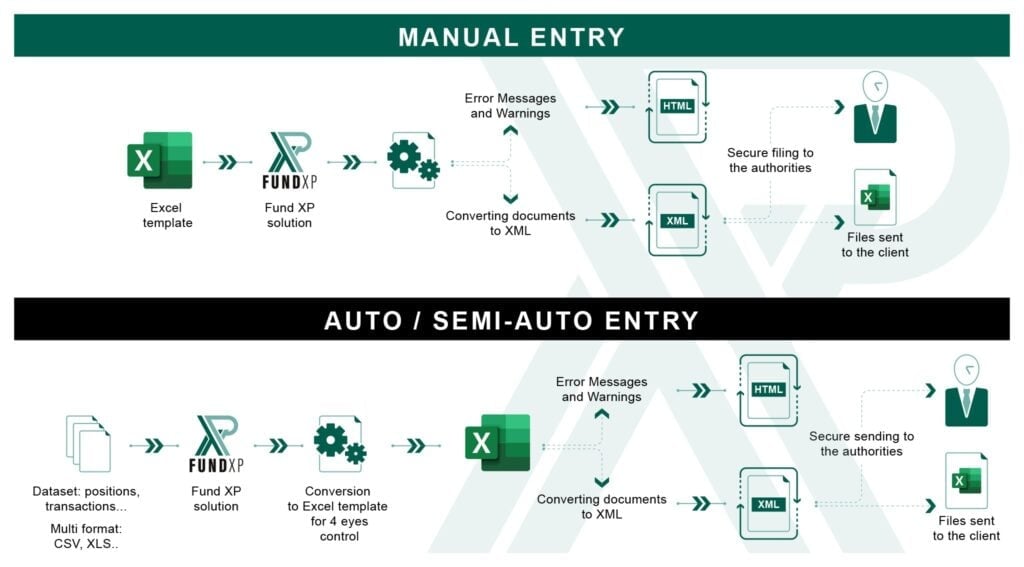

Whether you manage a single fund or a diverse portfolio, our two scalable solutions will adapt. They are designed to meet your unique needs.

-

CUSTOMIZED REPORTING TEMPLATES

Say goodbye to manual data gathering and formatting headaches. Our tailored reporting templates align seamlessly with the requirements, ensuring accuracy and efficiency in your reporting processes.

-

AUTOMATED DATA INTEGRATION

Streamline data collection from diverse sources effortlessly. Our automated AIFMD Annex IV reporting software integrates with your existing systems. It consolidates data swiftly and securely for comprehensive reporting.

-

ACCURACY

More than 800 robust controls are in place to prevent errors or omissions.

-

FLEXIBILITY

Our AIFMD solution can handle multiple jurisdictions‘ reporting formats. (AFM, AMF, BaFIN, BCIE, CONSOB, CSSF, FCA, FSMA, MFSA, …)

-

TRANSPARENCY

Each report will be produced in XML and its equivalent in Excel format.

-

FILING

Optionally, we can do the secure filing to the authorities and the feedback fellowship.

-

TIMELINESS

Our fully automatic solution enables AIFMs to meet the required reporting deadlines.

-

USER FRIENDLY

The solution is easy for users to understand and use, with clear instructions and intuitive interfaces. From excel to Annex iv XML.

-

SUPPORT

Free, adequate business/technical support and helpdesk.

Why choose us?

We are proud to share that 0 clients have left our AIFMD reporting platform, reflecting our commitment to delivering exceptional support and compliance solutions. We cater to clients of all sizes, from 1 AIF to more than 100, when it comes to the AIFMD Annex IV reporting.

- Experience: With years of industry expertise, we understand the nuances of AIFMD Annex IV reporting, empowering you with insights and solutions tailored to your specific challenges.

- Reliability: Trust is the cornerstone of our services. Count on us to deliver accurate, timely, and compliant reporting solutions.

- Innovation: Stay ahead of the curve with our innovative technologies and agile methodologies. We continuously refine our solutions to anticipate and address emerging regulatory demands, ensuring your compliance journey remains seamless.

Get Started Today

Don’t let reporting complexities hinder your operational efficiency. Partner with us to unlock streamlined reporting processes, regulatory compliance excellence, and peace of mind. Contact us today to schedule a consultation and take the first step toward effortless compliance.

AIFMD Annex IV reporting requirements

ESMA reporting requirements guidance refers to the standardized framework established by the European Union for reporting by financial intermediaries and fund managers under the AIFMD. The objective of this guidance is to ensure transparency and risk management by requiring detailed information on assets, liquidity, leverage, risk profiles, and exposures of AIFs. Fund managers are required to submit periodic reports based on specific templates and formats outlined in the AIFMD Annex iv Reporting Guidance, which facilitates regulatory oversight and ensures consistency in the financial data reported across the EU.

Guidance : https://www.esma.europa.eu/sites/default/files/library/2015/11/2014-869.pdf

Procedures for Reporting

A. First Reporting

- If no information is available (e.g., delay in activity start), AIFMs must still submit a report indicating no information using a specific field.

- Reporting starts from the first day of the quarter following when information becomes available, covering until the end of that first reporting period.

- AIFMs submit only one report per reporting period, covering the entire period.

B. Change of AIFM or AIF Liquidation

- Change of AIFM: The new AIFM reports information for the entire period, using data from the former AIFM. The former AIFM does not report.

- Liquidated or Merged AIF: The AIFM provides the last report immediately after liquidation or merger. The content may vary (e.g., no information, limited to turnover, or complete) depending on the stage of liquidation and whether a liquidator has taken over.

C. New Reporting Obligations for AIFMs (Shift in Frequency/Scope)

- Procedures assume AIFMs are prepared for new obligations upon authorization.

- AIFMs indicate the change in reporting frequency using a specific field in the first report after the shift.

- Only one report is sent, even if it covers multiple reporting periods due to the change.

AIF Data Reporting (Articles 3(3)(d) and 24(1))

A. Identification of the AIF

- Legal name (including umbrella and sub-fund names).

- AIF identification code (national, ISIN, other international, LEI/IEI).

- Inception date, domicile (home Member State for EU AIFs, authorization/registration country for non-EU AIFs).

- Legal name and LEI/IEI/BIC of prime brokers.

- Base currency (single currency, ISO 4217 code).

- Total assets under management (in base currency and Euro, with NAV).

- Jurisdiction of the three main funding sources (jurisdiction of the counterparty, e.g., lender).

B. Predominant AIF Type and Breakdown of Investment Strategies

- Select one predominant AIF type (Hedge Fund, Private Equity Fund, Real Estate Fund, Fund of funds, Other, None) based on NAV.

- Provide breakdown of investment strategies based on Annex II, Table 3.

- Strategies are mutually exclusive (except when ‘None’ is selected for predominant AIF type).

- Primary strategy: best describes the fund; Multi-strategy: diversified across multiple strategies.

- Report percentage of NAV for strategies (sum to 100%, except for multi-strategy where percentages are for underlying strategies).

- Money market AIFs are “fixed income”.

C. Principal Exposures and Most Important Concentration

- Main instruments traded by the AIF: Top 5 individual instruments based on value. Identify sub-asset type, instrument code (ISIN/AII for derivatives), value, and long/short position.

- Geographical focus: Domicile of investments. Mutually exclusive regions, sum to 100%. “Supranational/multiple regions” for non-predominant focus or insufficient info on CIUs. Derivatives domicile based on underlying assets; cash deposits based on currency.

- 10 principal exposures by sub-asset type: Group by sub-asset type, long/short, and report aggregated value and % of AuM. Do not net positions within the same sub-asset type. Report counterparty (LEI/IEI) if single counterparty; aggregate group counterparties.

- 5 most important portfolio concentrations: By asset type, market (MIC or ‘XXX’/’OTC’), aggregated value, and long/short position.

- Typical deal/position size for Private Equity AIFs: Select one size from a predefined list (e.g., Very small, Small, Lower/mid-market, etc.).

- Principal markets in which the AIF trades: Same approach as for AIFM level, but applied to the AIF.

- Investor concentration: Percentage of units/shares in relation to NAV for top 5 beneficial owners (aggregate group investors). Breakdown between retail and professional clients (sum to 100%).

AIF Data Reporting (Article 24(2))

A. Instruments Traded and Individual Exposures

- Report in base currency of the AIF, to the highest level of detail.

- Detailed definitions and inclusion/exclusion rules for various asset classes (e.g., Cash and cash equivalents, Listed/Unlisted equities, Corporate/Sovereign/Municipal/Convertible bonds, Leveraged/Other loans, Structured/securities products, Equity/Fixed income/Credit default/Commodity/Foreign exchange/Interest rate/Other derivatives, Real estate/tangible assets, Commodities, Investments in funds, Other asset classes).

- Report long and short values, and gross value where relevant, at sub-asset type level.

B. Value of Turnover

- Report at sub-asset type level.

- Sum of absolute values of buys and sells during the reporting period.

- Notional values for derivatives in accordance with Article 10 of the Regulation; packages can be treated as single positions.

C. Currency Exposure

- Long and short values for exposure by currency group, denominated in the AIF’s base currency.

D. Dominant Influence (for Private Equity AIFs only)

- Legal name, LEI/IEI/BIC of companies where AIF has dominant influence.

- Percentage of voting rights and type of transaction (e.g., Acquisition capital, Buyouts, Growth Capital, Recapitalisation, etc., based on Annex II, Table 5).

E. Risk Profile of the AIF

- Market Risk: Report Net DV01 (in three maturity buckets), CS 01 (in three maturity buckets), and Net Equity Delta. Use consistent methodology. Explain ‘0’ values.

- Counterparty Risk:Trading and clearing mechanisms: Report on derivative transactions cleared under EMIR (excluding listed derivatives) and repo/reverse repo transactions.

- Value of collateral: All collateral posted to counterparties (mark-to-market value). Netting allowed for repos/reverse repos with same counterparty and collateral type.

- Re-hypothecation rate: Percentage of re-hypothecated collateral to total posted collateral. Indicate “No” if not allowed.

- Top five counterparties: Net exposure (after collateral) as % of NAV. Include name, BIC, LEI/IEI. Aggregate group counterparties.

- Direct clearing through CCPs: Name, LEI/IEI, BIC of top 3 CCPs by net credit exposure.

- Liquidity Profile:Portfolio liquidity profile: Percentage of portfolio liquidable within specified periods (e.g., <1 day, 1-7 days). Each investment assigned to shortest liquidation period; total must equal 100%. Group contingent parts of trades under least liquid part.

- Investor liquidity profile: Division of NAV based on shortest withdrawal/redemption period. Assume gates are imposed but no suspensions or redemption fees. Total must equal 100%.

- Investor redemptions: Select frequency (Daily, Weekly, Monthly, Quarterly, etc.) or “None”. If multiple share classes, report for largest.

- Breakdown of ownership: Percentage of NAV by investor typology (e.g., Non-financial corporations, Banks, Pension plans, Households).

F. Borrowing and Exposure Risk

- Value of borrowings: Collateralized borrowings classified by legal agreement. Borrowings embedded in financial instruments (gross notional exposure minus margins). Separate exchange-traded and OTC derivatives. Values in AIF’s base currency.

- Leverage of the AIF: Report as percentage of NAV using Gross and Commitment methods.

G. Operational and Other Risk Aspects

- Total number of open positions: At position level, not issuer level.

- Gross/Net investment returns: For each month of the reporting period, at AIF level (not per share class).

- Change in NAV: For each month, net of fees and including subscriptions/redemptions.

- Number of subscriptions (for Private Equity AIFs): Based on actual amount paid by investors per month.

Information under Article 24(4)

A. Largest Sources of Borrowed Cash or Securities

- Top five sources (short positions).

- Name, LEI/IEI/BIC of entity, and corresponding amount in AIF’s base currency.

What is AIFMD Annex IV reporting?

The AIFMD Annex IV report is a reporting requirement for alternative investment fund managers (AIFMs) under the Alternative Investment Fund Managers Directive (AIFMD).

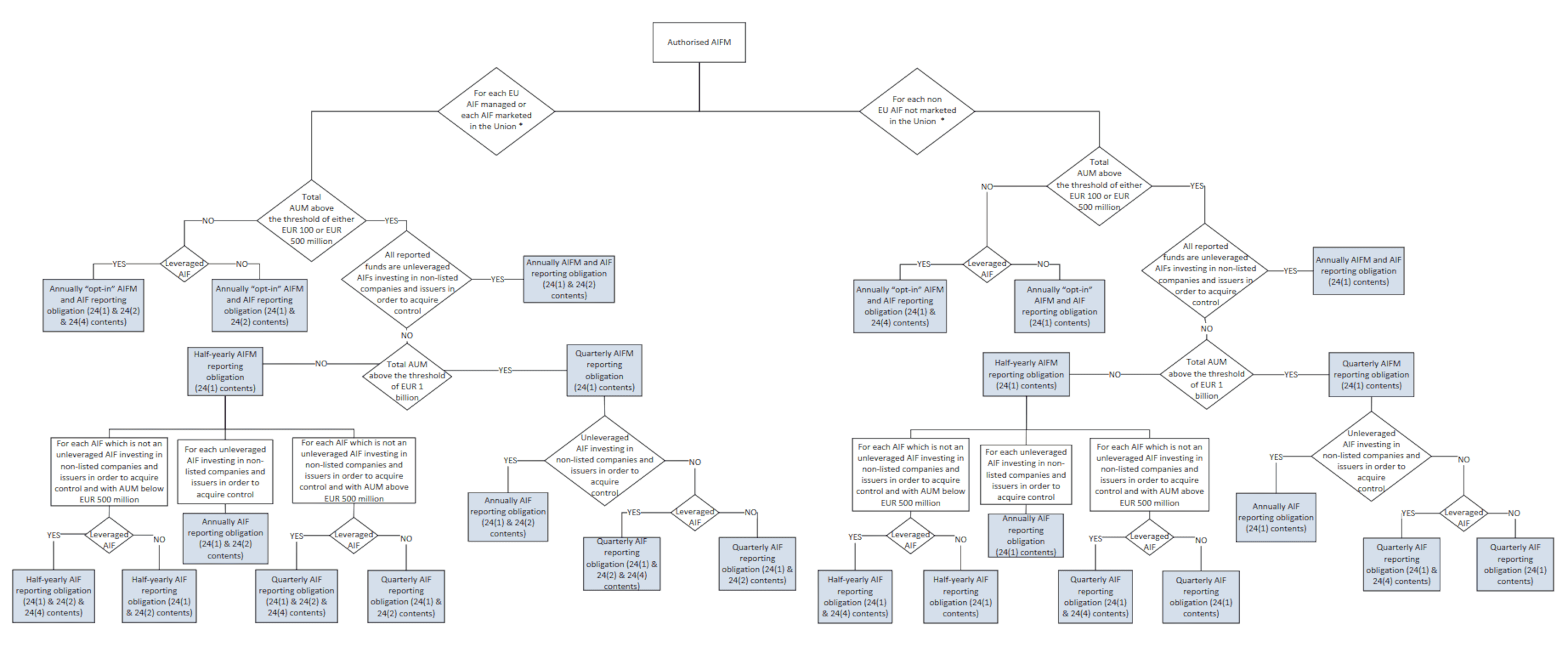

AIFMs must report certain information to the competent authorities on an annual, half-yearly or quarterly basis depending on the leverage, the assets under management (AuM), the assets held and if the AIFM is registered or authorised.

The AIFMD reports contain detailed information about the AIFM and the alternative investment funds (AIFs) it manages. This includes information about the AIFM’s operations, and details about the AIFs, such as their investment strategies, portfolio holdings, stress tests, and leverages.

The report is intended to provide regulators with a comprehensive overview of the AIFM and the AIFs it manages to ensure that they are operating transparently and responsibly.

It is an important tool for regulators to monitor the activities of AIFMs and ensure that they comply with relevant regulations.

What are the reporting periods for the AIFMD Annex IV reporting?

The Annex iv reporting frequency is annually, semi-annually, or quarterly, depending on various factors such as assets under management (AuM), leverage levels, asset types, and the registration or authorisation status of the AIFM. The initial filing deadline is set at 30 days following the conclusion of the first reporting period after the authorisation of the AIFM. Fund-of-Funds, however, are granted an additional 15 days to comply with the deadline.

- Yearly reporting: 30 or 45 days after the 31st of December.

- Half-yearly reporting: 30 or 45 days after the 30th of June and the 31st of December.

- Quarterly reporting: 30 or 45 days after the end of March, June, September and December.

Click on the image below to determine your reporting frequency:

AIFMD 2

Full text: https://www.consilium.europa.eu/media/67845/st14932-en23.pdf

The Article 24 is amended as follow (hashed =cancelled, bold=new):

Reporting obligations to competent authorities

1. An AIFM shall regularly report to the competent authorities of its home Member State on the principal markets and instruments in which it trades on behalf of the AIFs it manages. It shall provide information on the main instruments in which it is trading, on markets of which it is a member or where it actively trades, and on the principal exposures and most important concentrations of each of the AIFs it manages.

It shall, in respect of each AIF it manages, provide information on the instruments in which it is trading, on markets of which it is a member or where it actively trades, and on the exposures and assets of the AIF. That information shall include the identifiers that are necessary to connect the data provided on assets, AIFs and AIFMs to other supervisory or publicly available data sources.’;

- The addition of identifiers (likely such as Legal Entity Identifiers – LEIs or other specific codes) enables better integration of AIF data with other supervisory or public data sources. This allows regulators to connect different datasets for a more detailed and traceable view of the AIF’s positions and risk exposures.

- AIFMs will need to report detailed data for each AIF, rather than aggregate data.

2. An AIFM shall, for each of the EU AIFs it manages and for each of the AIFs it markets in the Union, provide the following to the competent authorities of its home Member State:

(a) the percentage of the AIF’s assets which are subject to special arrangements arising from their illiquid nature;

(b) any new arrangements for managing the liquidity of the AIF;

(c) the current risk profile of the AIF and the risk management systems employed by the AIFM to manage including the market risk, liquidity risk, counterparty risk and other risks including operational risk;

(d) information on the main categories of assets in which the AIF invested; and information regarding delegation arrangements concerning portfolio management or risk management functions as follows:

- information on the delegates, specifying the delegates’ name and domicile, whether they have any close links with the AIFM, whether they are authorised or regulated entities for the purpose of asset management and where relevant, their supervisory authority, including the identifiers of the delegates that are necessary to connect the information provided to other supervisory or publicly available data sources;

- the number of full-time equivalent human resources employed by the AIFM for performing day-to-day portfolio or risk management tasks within the AIFM; 2a) a list and description of the activities concerning risk management and portfolio management functions which are delegated;

- where the portfolio management function is delegated, the amount and percentage of the AIF’s assets which are subject to delegation arrangements concerning the portfolio management function;

- the number of full-time equivalent human resources employed by the AIFM to monitor the delegation arrangements;

- the number and dates of periodic due diligence reviews carried out by the AIFM to monitor the delegated activity, a list of issues identified and, where relevant, the measures adopted to address those issues and the date by which those measures are to be implemented

- where sub-delegation arrangements are in place, information required in points (1), (2a) and (3) in respect of the sub-delegates and the activities related to the portfolio and risk management functions that are sub-delegated;

- the commencement and expiry dates of the delegation and sub-delegation arrangements.;

(e) the results of the stress tests performed in accordance with point (b) of Article 15(3) and the second subparagraph of Article 16(1).

(f) the list of Member States in which the units or shares of the AIF are actually marketed by the AIFM or by a distributor which is acting on behalf of that AIFM.;

- Information on delegates: This ensures greater transparency regarding the entities handling critical functions for the AIF, facilitating regulatory oversight of delegated functions.

- Human Resources (HR) Data: AIFMs will need to track and report their internal resource allocation, providing insight into whether the AIFM is adequately staffed for its oversight role.

- Due Diligence Reviews: AIFMs need to document their monitoring processes more thoroughly, including maintaining records of due diligence and follow-up actions.

- Member States in which ther shares are actually marketed

FCA AIFMD reporting

UK-based Alternative Investment Fund Managers (AIFMs) and Alternative Investment Funds (AIFs) were only obligated to submit AIFMD Annex IV reports to the Financial Conduct Authority (FCA). However, following the transition period’s conclusion, UK AIFs with investors from EU jurisdictions under the Alternative Investment Fund Managers Directive (AIFMD) must now submit reports to each jurisdiction. Ensure full compliance with AIFMD and FCA Annex IV reporting requirements using our AIFMD compliance software.

AIFMD Annex IV – Useful links

- ESMA AIFMD Annex IV Guidelines

- ESMA FAQ

- AIFMD Annex IV IT technical guidance (rev 6)

- ESMA Guidelines on Article 25 (Risk / Leverage)

- ESMA Final Report on Guidelines on Article 25

- ESMA Opinion on Risk Metrics

- Guidelines on liquidity stress testing in UCITS and AIFs per jurisdiction

- CSSF AIFM Reporting – Technical Guidance

- CSSF Circular 14/581

- CSSF Circular 23/844

- CSSF AIFMD webpage

- CSSF AIFMD FAQ

- CSSF AIFMD Annex IV identifiers list

CSSF S3

The CSSF deploys the S3 (Simple Storage Service) solution, an object storage system accessible via a web service interface for secure file exchanges.

In the CSSF S3 system, data is stored as objects organised within buckets. An object represents a file and includes associated metadata.

Fund XP has developed a solution to allow Fund Managers to quickly explore, manage, and optimise their AIFMD filing.

Learn more about our CSSF S3 Bucket Explorer: