Are you grappling with AIFMD Annex IV reporting requirements? Look no further! Our comprehensive solutions are designed to simplify the intricate landscape of regulatory compliance.

With more than 2000 reports per year and more than 800 checks, we ensure high-quality know-how and the correctness of our reports.

We build reports using complete automatic processes and automated validation checks (Local authority & ESMA). We stay current with the latest specifications, ensuring that our software reflects any changes or updates. Our reports are always compliant with the current regulatory standards.

Optionally, we can act as a technical sender and do the filing to the authorities. (free filing using the CSSF S3 for Luxembourg)

-

SCALABLE SOLUTIONS

Whether you manage a single fund or a diverse portfolio, our scalable solutions adapt to your unique needs. Grow with confidence, knowing that our robust infrastructure can accommodate your evolving reporting requirements.

-

CUSTOMIZED REPORTING TEMPLATES

Say goodbye to manual data gathering and formatting headaches. Our tailored reporting templates align seamlessly with AIFMD Annex IV requirements, ensuring accuracy and efficiency in your reporting processes.

-

AUTOMATED DATA INTEGRATION

Streamline data collection from diverse sources effortlessly. Our automated solutions integrate with your existing systems, consolidating data swiftly and securely for comprehensive reporting.

-

ACCURACY

More than 800 robust controls are in place to prevent errors or omissions.

-

FLEXIBILITY

The solution can handle multiple jurisdictions‘ reporting formats. (AFM, AMF, BaFIN, BCIE, CONSOB, CSSF, FCA, FSMA, MFSA, …)

-

TRANSPARENCY

Each report will be produced in XML and its equivalent in Excel format.

-

FILING

Optionally, we can do the secure filing to the authorities and the feedback fellowship.

-

TIMELINESS

Our fully automatic solution enables AIFMs to meet the required reporting deadlines.

-

USER FRIENDLY

The solution is easy for users to understand and use, with clear instructions and intuitive interfaces. From excel to Annex iv XML.

-

SUPPORT

Free, adequate support and helpdesk.

Why choose us?

- Experience: With years of industry expertise, we understand the nuances of AIFMD Annex IV reporting, empowering you with insights and solutions tailored to your specific challenges.

- Reliability: Trust is the cornerstone of our services. Count on us to deliver accurate, timely, and compliant reporting solutions.

- Innovation: Stay ahead of the curve with our innovative technologies and agile methodologies. We continuously refine our solutions to anticipate and address emerging regulatory demands, ensuring your compliance journey remains seamless.

Get Started Today

Don’t let AIFMD Annex IV reporting complexities hinder your operational efficiency. Partner with us to unlock streamlined reporting processes, regulatory compliance excellence, and peace of mind. Contact us today to schedule a consultation and take the first step toward effortless compliance.

What is AIFMD Annex IV reporting?

The AIFMD Annex IV report is a reporting requirement for alternative investment fund managers (AIFMs) under the Alternative Investment Fund Managers Directive (AIFMD).

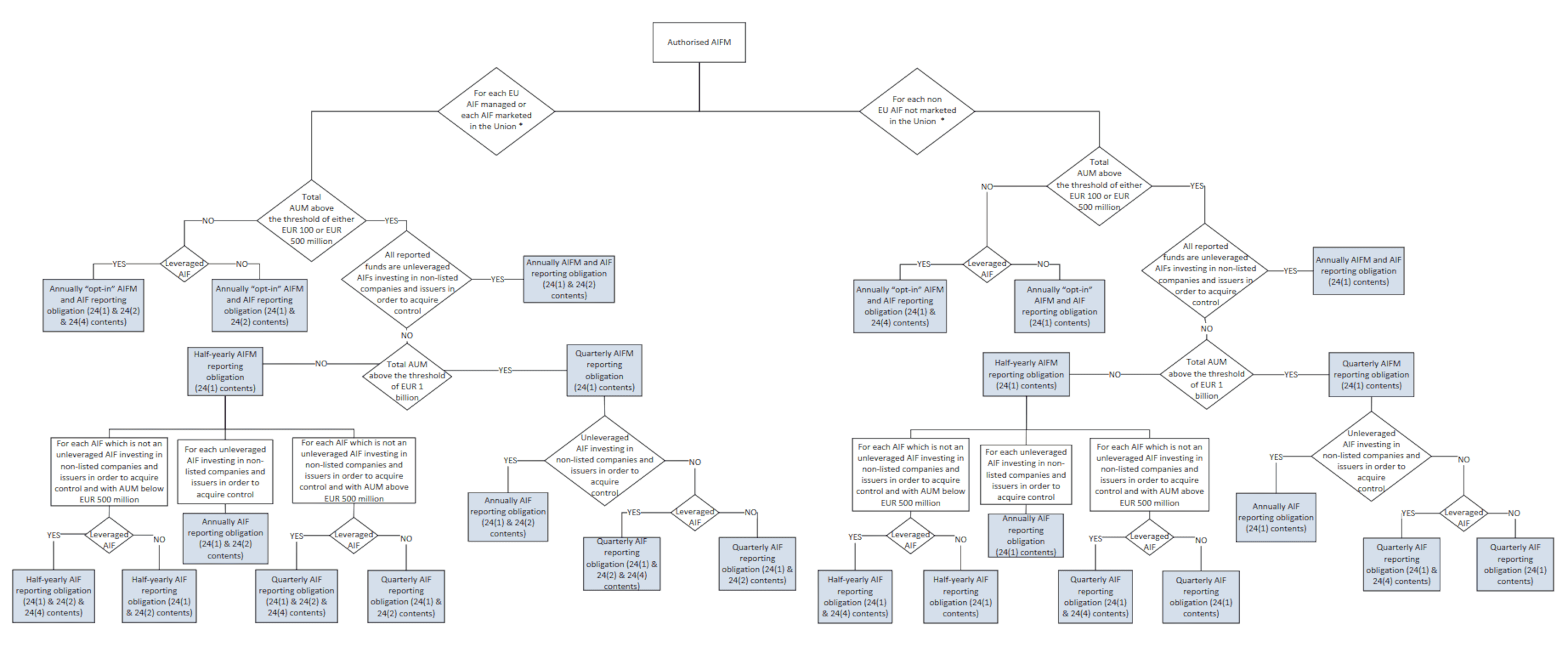

AIFMs must report certain information to the competent authorities on an annual, half-yearly or quarterly basis depending on the leverage, the assets under management (AuM), the assets held and if the AIFM is registered or authorised.

The AIFMD Annex IV report contains detailed information about the AIFM and the alternative investment funds (AIFs) it manages. This includes information about the AIFM’s operations, and details about the AIFs, such as their investment strategies, portfolio holdings, stress tests, and leverages.

The AIFMD Annex IV report is intended to provide regulators with a comprehensive overview of the AIFM and the AIFs it manages to ensure that they are operating transparently and responsibly.

It is an important tool for regulators to monitor the activities of AIFMs and ensure that they comply with relevant regulations.

What is the frequency of AIFMD reporting?

The AIFMD Annex IV transparency reporting must be submitted annually, semi-annually, or quarterly, depending on various factors such as assets under management (AuM), leverage levels, asset types, and the registration or authorisation status of the AIFM. The initial filing deadline for the AIFMD Annex IV report is set at 30 days following the conclusion of the first reporting period after the authorisation of the AIFM. Fund-of-Funds, however, are granted an additional 15 days to comply with the deadline.

- Yearly reporting: 30 or 45 days after the 31st of December.

- Half-yearly reporting: 30 or 45 days after the 30th of June and the 31st of December.

- Quarterly reporting: 30 or 45 days after the end of March, June, September and December.

Click on the image below to determine your reporting frequency:

What data fields and information need to be reported?

- AIF Information:

-

- Details of each AIF managed, including its name, type, assets under management (AUM), and domicile.

- Information on the AIF’s investment strategy and objectives.

-

- Investor Information:

-

- Information about the AIF’s investors, including their categorisation (e.g., professional or retail), and the number of investors in each category.

- Information on the AIF’s largest investors.

-

- Asset Information:

-

- Information on the AIF’s assets, including the asset classes in which it invests and their geographical distribution.

- Information on the use of leverage within the AIF.

-

- Portfolio Information:

-

- Details of the AIF’s portfolio, including financial instruments and derivatives positions.

-

- Risk Metrics:

-

- Risk-related data, include value-at-risk (VaR), stress testing results, and concentration risk.

-

- Liquidity Information:

-

- Information on the liquidity profile of the AIF, including the liquidity of its assets and redemption terms for investors.

-

- Counterparty Information:

-

- Details of significant counterparties, including prime brokers and custodians.

-

FCA – UK

UK-based Alternative Investment Fund Managers (AIFMs) and Alternative Investment Funds (AIFs) were only obligated to submit Annex IV reports to the Financial Conduct Authority (FCA). However, following the transition period’s conclusion, UK AIFs with investors from EU jurisdictions under the Alternative Investment Fund Managers Directive (AIFMD) must now submit Annex IV reports to each jurisdiction.

Useful links

- ESMA Guidelines

- ESMA FAQ

- AIFMD reporting IT technical guidance (rev 6)

- ESMA Guidelines on Article 25 (Risk / Leverage)

- ESMA Final Report on Guidelines on Article 25

- ESMA Opinion on Risk Metrics

- Guidelines on liquidity stress testing in UCITS and AIFs per jurisdiction

- CSSF AIFM Reporting – Technical Guidance

- CSSF Circular 14/581

- CSSF Circular 23/844

- CSSF AIFMD reporting webpage

- CSSF AIFMD FAQ

- CSSF AIFMD identifiers list

List of competent authorities

- Belgium – FSMA – Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers

- Bulgaria – FSC – Комисия за финансов надзор

- Czech Republic – CNB – Česká národní banka

- Denmark – Finanstilsynet

- Germany – BaFIN – Bundesanstalt für Finanzdienstleistungsaufsich

- Estonia – FSA – Finantsinspektsioon

- Ireland – CBIE – Central Bank of Ireland

- Greece – HCMC – Επιτροπή Κεφαλαιαγοράς

- Spain – CNMV – Comisión Nacional del Mercado de Valores

- France – AMF ACP – Autorité des Marchés Financiers Autorité de Contrôle Prudentiel

- Croatia – HANFA – Hrvatska agencija za nadzor financijskih usluga

- Italy – CONSOB – Commissione Nazionale per le Società e la Borsa Banca d’Italia

- Cyprus – CySEC – Επιτροπή Κεφαλαιαγοράς

- Latvia – Latvijas Banka

- Lithuania – LB – Lietuvos bankas

- Luxembourg – CSSF – Commission de Surveillance du Secteur Financier

- Hungary – MNB – Magyar Nemzeti Bank

- Malta – MFSA – Awtorita’ ghas-Servizzi Finanzjari ta’ Malta

- Netherlands – AFM DNB – Autoriteit Financiële Markten De Nederlandsche Bank

- Austria – FMA – Österreichische Finanzmarktaufsicht

- Poland – KNF – Komisja Nadzoru Finansowego

- Portugal – CMVM – Comissão do Mercado de Valores Mobiliários Banco de Portugal

- Romania – ASF – Autoritatea de Supraveghere Financiara

- Slovenia – A-TVP – Agencija za trg Vrednostnih Papirjev

- Slovakia – NBS – Národná Banka Slovenska

- Finland – FIN-FSA – Finanssivalvonta

- Sweden – FI – Finansinspektionen

- Iceland – CBI – Central Bank of Iceland

- Liechtenstein – FMA – Finanzmarktaufsicht Liechtenstein

- Norway – Finanstilsynet

CSSF S3

The CSSF deploys the S3 (Simple Storage Service) solution, an object storage system accessible via a web service interface for secure file exchanges.

In the CSSF S3 system, data is stored as objects organised within buckets. An object represents a file and includes associated metadata.

Fund XP has developed a solution to allow Fund Managers to quickly explore, manage, and optimise their AIFMD reporting filing.

Learn more about our CSSF S3 Bucket Explorer: