What Are the Key Requirements of Report S 2.14?

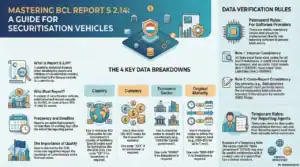

This briefing provides a detailed analysis of the reporting requirements for the Banque centrale du Luxembourg (BCL) report S 2.14, “Quarterly statistical balance sheet of securitisation vehicles.” The report is a critical component of the Eurosystem’s data collection framework, with data being aggregated by the European Central Bank (ECB). Consequently, the BCL places significant emphasis on the quality and accuracy of submissions, warning that “Any error or important negligence will have harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.”

- Reporting Mandate: All securitisation vehicles in Luxembourg are subject to the reporting mandate, regardless of legal status or CSSF supervision. However, the BCL implements a derogation system, selecting a sample of vehicles that account for at least 95% of total sector assets to reduce the burden on smaller entities.

- Frequency and Deadline: Report S 2.14 is a quarterly submission, due to the BCL within 20 working days following the end of the reference period.

- Data Complexity: Submissions require a granular breakdown of assets and liabilities across four distinct criteria: Country of the counterpart (ISO 3166), Currency of the transaction (ISO 4217), Economic Sector of the counterpart, and Original Maturity. Specific codes, including “No breakdown” options for certain line items, must be used correctly.

- Rigorous Verification: The BCL applies a multi-layered verification process. This includes Permanent Rules (e.g., balance sheet totals must match, specific line items require fixed codes) and Temporary Rules (e.g., linking specific sector codes to country types). Crucially, a consistency check is mandated between amounts in report S 2.14 and the corresponding data in the Security-by-Security (SBS) reporting.

- Operational Challenge: The combination of detailed data breakdowns, strict coding and formatting rules, and complex internal and external consistency checks presents a significant operational challenge for reporting agents, increasing the risk of errors and non-compliance.

1. What Is Report S 2.14 and Why Is It Important?

The S 2.14 report is the “Quarterly statistical balance sheet of securitisation vehicles,” a mandatory statistical data collection conducted by the Banque centrale du Luxembourg. Its primary objective is to gather comprehensive data on the assets and liabilities of these entities.

The BCL stresses the importance of data quality, as the information is subsequently checked and aggregated by the European Central Bank (ECB) with data from other Eurozone member states. The integrity of these submissions directly impacts the perceived reliability and reputation of Luxembourg’s financial sector.

2. Who Must Report, and How Frequently?

2.1. Which Securitisation Vehicles Are Required to Report?

The reporting obligation applies to all securitisation vehicles, irrespective of their legal status or whether they are supervised by the Commission de Surveillance du Secteur Financier (CSSF).

Based on Regulation (EU) n°1075/2013 (ECB/2013/40), the BCL has the authority to grant exemptions to smaller reporting agents. The selection of entities required to report is managed by the BCL and revised annually. The goal is to ensure that the reporting vehicles collectively represent at least 95% of the total assets of all securitisation vehicles, thus ensuring comprehensive market coverage while minimizing the burden on modest-sized operations.

2.2. How Often Must S 2.14 Be Submitted, and What Are the Deadlines?

Report S 2.14 must be submitted to the BCL on a quarterly basis. The submission deadline is 20 working days following the end of the quarter to which the report relates. The BCL publishes the exact reporting dates on its official website.

3. What Core Data Structure and Breakdowns Are Required?

Assets and liabilities reported under S 2.14 must be disaggregated according to four key criteria. For certain line items where a breakdown is not required, specific “No breakdown” codes must be used.

3.1. How Should Country Breakdown Be Reported?

Data must be split by the counterparty’s country of residency, using the two-character ISO 3166 code. In addition, specific codes are designated for European and international institutions.

| Code | Institution |

|---|---|

| XA | European Central Bank (ECB) |

| XB | International institutions (non-European), outside Luxembourg |

| XC | International institutions (non-European), in Luxembourg |

| XD | European institutions in Luxembourg |

| XE | European Investment Bank (EIB) |

| XG | European institutions outside Luxembourg (except ECB) |

| XI | European Stability Mechanism (ESM) |

| XJ | European Financial Stability Facility (EFSF) |

| XX | No breakdown (use restricted to specific lines) |

3.2. How Should Currency Breakdown Be Reported?

Transactions must be broken down by the currency of denomination using the three-character ISO 4217 code.

- No breakdown code: XXX (use restricted to specific lines)

3.3. How Should Economic Sector Breakdown Be Reported?

Counterparties must be classified using a five-character economic sector code.

| Code | Economic Sector |

|---|---|

| 11000 | Central government |

| 12100 | State government |

| 12200 | Local government |

| 12300 | Social security funds |

| 21000 | Non-financial corporations |

| 22110 | Households – Sole proprietors |

| 22120 | Households – Physical persons |

| 22200 | Non-profit institutions serving households |

| 31000 | Central banks |

| 32100 | Deposit taking corporations – Credit institutions |

| 32200 | Deposit taking corporations – Other |

| 33000 | Money market funds |

| 41000 | Non-monetary investment funds |

| 42100 | Securitisation vehicles |

| 42200 | Central counterparties |

| 42900 | Other financial intermediaries |

| 43000 | Financial auxiliaries |

| 44000 | Captive financial institutions and money lenders |

| 45000 | Insurance corporations |

| 46000 | Pension funds |

| 90000 | No breakdown (use restricted to specific lines) |

3.4. How Should Original Maturity Breakdown Be Reported?

| Code | Original Maturity |

|---|---|

| I000-01A | Up to 1 year |

| I01A-02A | Over 1 and up to 2 years |

| I02A-05A | Over 2 and up to 5 years |

| I05A-999 | Over 5 years |

| I999-999 | No breakdown (use restricted to specific lines) |

4. What Verification Rules and Consistency Checks Apply?

4.1. Permanent Verification Rules

- Every line item must have a valid value for all four breakdowns (country, currency, sector, maturity).

- The amount in “Total assets” (line 1-000000) must exactly match the amount in “Total liabilities” (line 2-000000).

- All lines must have a credit trend, with the exception of line 2-007000, which may have a debit trend.

- For specific lines where no breakdown is needed, the “No breakdown” codes (XX, XXX, 90000, I999-999) must be used.

Verification with Security-by-Security (SBS) Reporting:

- 1-003000: Debt securities held

- 1-005000: Equity and investment fund shares/units held

- 2-002050: Short sales of securities

- 2-003000: Debt securities issued

- 2-005000: Capital (equity, shares and units issued)

4.2. Temporary Verification Rules

- The sector code 12100 (State government) may only be used in combination with a country code of a nation that has a federal state structure.

5. How Can Fund XP Streamline S 2.14 Compliance?

- Automated Data Management: The solution automates the aggregation and formatting of data according to the BCL’s precise requirements for country, currency, sector, and maturity breakdowns.

- Integrated Validation Engine: Fund XP incorporates the BCL’s permanent and temporary verification rules directly into the workflow.

- Automated Consistency Checks: The platform performs reconciliation between the S 2.14 report and Security-by-Security (SBS) data.

- Efficient File Generation: The system automates the creation of the final submission file in the required technical format, such as XML.

By leveraging a specialized tool like Fund XP, reporting entities can transform the S 2.14 reporting process from a high-risk manual task into a controlled, efficient, and automated workflow, ensuring timely and accurate compliance while safeguarding their reputational standing.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL Website: https://www.bcl.lu/en/Regulatory-reporting/Vehicules_de_titrisation/Instructions/S0214/index.html