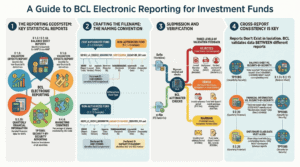

The Banque Centrale du Luxembourg (BCL), as a key member of the Eurosystem, mandates a rigorous and multi-faceted statistical reporting framework for all investment funds operating within its jurisdiction. This framework, critical for monetary and financial analysis, imposes significant operational and data management challenges on reporting entities. The requirements are characterized by highly specific technical formats, granular data breakdowns, strict submission deadlines, and an uncompromising emphasis on data quality and consistency across multiple reports.

Key reporting obligations include the monthly/quarterly statistical balance sheets (S 1.3 / S 2.13), the security-by-security holdings report (TPTOBS), the report on valuation effects (S 1.6), and the comprehensive quarterly financial information for non-authorized Alternative Investment Funds (S 2.20). Compliance demands adherence to intricate XML file naming conventions, detailed breakdowns of assets and liabilities by country, currency, economic sector, and maturity, and the provision of extensive supplementary data for securities lacking an ISIN.

Crucially, the BCL enforces a comprehensive set of internal and cross-report validation rules to ensure data integrity. Discrepancies between reports, such as a mismatch between the Total Net Asset Value in report S 2.20 and the sum of issued shares in the TPTOBS report, can lead to submission rejection. Failure to meet these standards presents significant operational burdens and reputational risks. Successfully navigating this landscape requires a sophisticated, automated solution capable of managing complex data, generating compliant reports, and performing rigorous pre-submission validation.

The BCL Reporting Framework: An Overview

The BCL’s data collection framework is essential for the European Central Bank (ECB) to compile comprehensive statistics on monetary and financial developments. The reporting obligations apply to all investment funds, including CSSF-authorized entities (UCITS, Part II UCI, SIF, SICAR) and non-authorized alternative investment funds (NAF, RAIF).

Primary Statistical Reports

| Report Name | Description | Reporting Population | Frequency & Deadline |

|---|---|---|---|

| S 1.3 | Monthly Statistical Balance Sheet | MMFs and most Non-MMF investment funds | MMFs: Monthly, within 10 working days Non-MMFs: Monthly, within 20 working days |

| S 2.13 | Quarterly Statistical Balance Sheet | Non-MMF investment funds with less than monthly asset valuation | Quarterly, within 20 working days |

| S 1.6 | Information on Valuation Effects | Non-monetary funds where certain asset categories exceed 5% of total assets | Monthly, within 20 working days |

| S 2.20 | Quarterly Financial Information | Non-authorised AIFs (NAFs) with assets > EUR 300 million | Quarterly, within 20 working days |

| TPTOBS | Security-by-Security Report | All investment funds | MMFs: Monthly, within 10 working days Non-MMFs: Monthly, within 20 working days |

| S 4.4 | Geographical Breakdown of Portfolio | All investment funds | Monthly / Quarterly |

Core Technical and Data Requirements

Compliance with BCL regulations extends beyond data provision and requires strict adherence to transmission, formatting, and structural standards.

Electronic Transmission and Formatting

- Format: All reports must be transmitted electronically in a specific XML format based on a tree-structured menu.

- Transmission Channels: Approved secure channels include:

- Sofie (Worldline Financial Services)

- e-file (FE fundinfo)

- File Naming Conventions: A rigid and structured naming convention is enforced. The filename encodes report type, layout version, reference period, reporter ID, declarant ID, creation date, and sequence number. The structure varies by regulatory status.

CSSF-Authorised Funds

S0000_L2_yyyymm_Rrrrrrrrrr_Dddddddddd_yyyymmdd_nnn

Example:

S0103_L4_202512_B000000789_O001220003_20260109_001.xml

Non-Authorised NAFs

S0000_L2_yyyymm_Rrrrrrrrrr_Ddddddddddddddd_yyyymmdd_nnn

Example:

S0213_L2_202512_B000000789_NAF66012345600001_20261020_001.xml

Data Granularity and Breakdowns

For balance sheet reports S 1.3 and S 2.13, assets and liabilities must be broken down according to four distinct criteria. “No breakdown” codes (e.g., XX, XXX, 90000) are only permitted for specific BCL-designated items.

1. Country

Counterparty residency must be identified using a two-character ISO 3166 code. Specific codes apply to European and international institutions (e.g., XA for ECB).

2. Currency

Assets and liabilities must be reported using a three-character ISO 4217 currency code.

3. Economic Sector

Counterparties must be classified using five-character codes.

| Code | Label | Code | Label |

|---|---|---|---|

| 11000 | Central government | 41000 | Non-MMF investment funds |

| 21000 | Non-financial corporations | 42900 | Other financial intermediaries |

| 31000 | Central bank | 43000 | Financial auxiliaries |

| 32100 | Credit institutions | 45000 | Insurance corporations |

| 33000 | Money market funds (MMF) | 46000 | Pension funds |

4. Initial Maturity

| Code | Initial Maturity |

|---|---|

| I000-01A | Up to 1 year |

| I01A-02A | Over 1 and up to 2 years |

| I02A-05A | Over 2 and up to 5 years |

| I05A-999 | Over 5 years |

Deep Dive into Key Reports and Their Challenges

TPTOBS: The Security-by-Security Mandate

The TPTOBS report requires a complete list of all securities held and issued.

- Core Challenge: Security identification. ISIN securities require basic quantitative data, while non-ISIN securities require extensive supplementary information.

- Non-ISIN Data Overhead: For each non-ISIN security:

- Legal Entity Identifier (LEI)

- National identifier (e.g., RCS for Luxembourg entities)

- Issuer country and economic sector

- For debt securities: issue date, maturity date, pool factor, coupon type, frequency, rate, and last payment date

- Operational Impact: Requires a robust, enriched security master database and strong data governance.

S 1.6: Isolating Transactions from Valuation Effects

Report S 1.6 enables the BCL to calculate real flows by separating transactions from valuation changes.

- Core Concept:

Net transactions = Stock(end) – Stock(start) – Net valuation effects - Reporting Trigger: Required only if non-financial assets or derivatives exceed 5% of total assets.

- Data Requirement: Reporting of aggregate market price and FX valuation effects.

S 2.20: Comprehensive Reporting for NAFs

Report S 2.20 imposes extensive quarterly disclosure for NAFs.

- Fund & Share Class Information: LEI, base currency, NAV frequency, redemption frequency, launch/closing dates, investor type, ISINs.

- Financial Data: Total NAV, issuance proceeds, redemptions, distributions.

- Income & Expenses: Detailed breakdown including dividends, interest, management fees, depository fees, administration fees, taxes, performance fees, and other operating costs.

The Critical Importance of Data Integrity and Validation

The BCL emphasizes that:

“Any error or important negligence will have harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.”

Validation Layers

- Internal Verification Rules: Ensure internal consistency within each report.

- Example: In S 4.4, country percentages must sum to exactly 100.

- TPTOBS checks include logical consistency of dates, coupon attributes, and classifications.

- Cross-Report Consistency Checks: Require perfect alignment across reports.

- TPTOBS debt securities totals must match S 1.3 / S 2.13.

- S 2.20 Total NAV must equal issued shares in TPTOBS.

- Share class unit counts in S 2.20 must match TPTOBS.

The Fund XP Solution: Automating Compliance and Ensuring Accuracy

Manual or fragmented reporting approaches are inefficient and high-risk. The Fund XP solution is purpose-built to address these challenges.

- Automated Report Generation: Automated XML creation for all BCL reports, ensuring compliance with layouts and naming conventions.

- Centralized Data and Logic: Single data source ensures consistency across all reports.

- Pre-submission Validation Engine: Enforces internal and cross-report rules before submission.

- Actionable Discrepancy Analysis: Highlights exact deltas between reported and expected figures, enabling rapid correction.

By leveraging the Fund XP solution, reporting agents can transform BCL reporting from a high-risk, labor-intensive process into a controlled, efficient, and automated workflow—ensuring timely compliance and the highest standards of data accuracy.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Fonds_Investissement/index.html