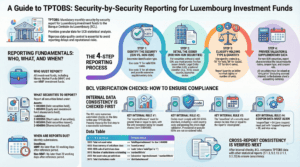

The Banque Centrale du Luxembourg (BCL) mandates that all Luxembourg-domiciled investment funds submit a monthly security-by-security statistical report, designated as TPTOBS. This report is a cornerstone of the data collection framework for both the BCL and the European Central Bank (ECB), designed to provide granular insight into the holdings and liabilities of the investment fund sector.

Compliance with the TPTOBS framework is characterized by its high degree of complexity and stringent data quality standards. The BCL emphasizes that the accuracy of this data is paramount, stating, “Any error or important negligence will have harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.”

Key challenges for reporting entities include adhering to a vast and detailed set of verification rules, providing extensive supplementary data for securities lacking an ISIN, and ensuring absolute consistency between the TPTOBS report and other regulatory filings, namely the S 1.3 / S 2.13 balance sheet reports and the U 1.1 / S 2.20 financial information reports. The operational burden is significant, requiring robust data management and validation processes to meet demanding deadlines and avoid compliance failures.

1. Overview of the TPTOBS Framework

1.1. Reporting Population and Scope

- Reporting Entities: The TPTOBS reporting obligation applies to all investment funds in Luxembourg. Each fund and/or sub-fund (compartment) must submit a separate monthly file.

- Scope: The report requires a detailed, security-level breakdown of specific asset and liability positions on the fund’s statistical balance sheet.

1.2. Reporting Frequency and Deadlines

The reporting is conducted on a monthly basis, with deadlines contingent on the fund’s classification:

- Money Market Funds (MMF): No later than 10 working days after the end of the reference period.

- Non-MMF Investment Funds: No later than 20 working days after the end of the reference period.

The BCL publishes an official calendar with specific remittance dates. The reference date for the report is the last day of each month, though the closing date for data can be prior to this, particularly if the NAV is not calculated daily or is unavailable at the transmission deadline.

1.3. Reportable Securities

The TPTOBS report covers securities that fall under the following lines of the S 1.3 and S 2.13 statistical balance sheets:

| Balance Sheet | Item Code | Description |

|---|---|---|

| Assets | 1-003000 | Debt securities held |

| Assets | 1-005000 | Equity and investment fund shares/units held |

| Liabilities | 2-002050 | Borrowings / Short sales of securities |

| Liabilities | 2-003000 | Debt securities issued |

| Liabilities | 2-004000 | Shares/units issued |

2. Core Reporting Principles and Data Requirements

A fundamental principle of the TPTOBS report is the distinction between securities identified by a valid ISIN code (Code Type ‘1’) and those without (Code Type ‘2’). While reporting for ISIN-identified securities is relatively straightforward, the requirements for non-ISIN securities are significantly more extensive.

2.1. Valuation and Amount Reporting

- Valuation: Quoted securities are valued at the prevailing market price on the reporting date. Debt securities must be valued using the “dirty price”, which includes accrued interest since the last coupon payment.

- Currency: All amounts must be expressed in the accounting currency of the balance sheet.

- Totals: A total amount (totalReportedAmount) must be reported for each balance sheet line, representing the exact sum of all individual security amounts within that line.

2.2. Type of Holding

To prevent double-counting, securities must be categorized based on the “economic holder” concept. This is a critical data point for all reported securities.

| Code | Type of Holding |

|---|---|

| 01 | Securities held and not affected by a temporary transfer |

| 02 | Securities lent |

| 03 | Securities sold in a repurchase agreement |

| 04 | Securities issued |

| 05 | Short sales of securities |

Securities received under a repurchase agreement or borrowed by the fund are not reported on the balance sheet and are thus excluded from TPTOBS reporting.

2.3. Extensive Data Requirements for Non-ISIN Securities

For any security reported without a valid ISIN (Code Type ‘2’), a comprehensive set of supplementary information is mandatory.

- Issuer Identification: This is a multi-part requirement:

- LEI Code: The Legal Entity Identifier must be provided. If none exists, a default value of 00000000000000000000 must be used.

- National Identifier: An identifier from the ECB’s official list must be provided. For Luxembourg entities, this is typically the RCS number. For public entities without an RCS, their international VAT number is used. For Luxembourg funds, specific CSSF or RCS-based formats are required. If no identifier is available, the type XX_NOTAP should be reported, though its use is expected to be exceptional.

- Country of Issuer: ISO 3166 code.

- Economic Sector of Issuer: A specific code from a BCL-provided list (e.g., 21000 for Non-financial corporations, 41000 for Non-MMF investment funds).

- Debt Security Characteristics (Item 1-003000, 2-002050, 2-003000):

- Security Type: Must be F.3.

- Dates: Issue Date and Final Maturity Date. Perpetual bonds use a default date of 01.01.2999.

- Pool Factor: Represents the percentage of principal remaining to be repaid. The default value is 1.

- Coupon Data: A full suite of coupon details is required, including couponType, couponFrequency, couponLastPaymentDate, and the annualized couponRate.

- Equity & Fund Share Characteristics (Item 1-005000, 2-002050):

- Security Type: Must be specified using codes such as F.511 (Quoted shares), F.512 (Unquoted shares), or F.52 (Shares/units of investment funds).

3. The Verification Rule Matrix: Ensuring Data Integrity

The BCL subjects every TPTOBS submission to a rigorous series of automated checks. These rules are detailed in the “Compendium of verification rules” and can be categorized into two main types.

3.1. Internal Consistency Checks

These rules validate the logical and structural integrity of the data within the TPTOBS file itself. There are over two dozen such rules, including:

- Amount Validity: The reportedAmount must be greater than or equal to zero (except for item 2-004000).

- ISIN Integrity: ISIN codes must conform to the ISO 6166 standard. Provisional or pseudo-ISINs are not considered valid and must be reported as non-ISIN securities.

- Conditional Logic: If a reportedAmount is greater than zero for a security quoted by number of units, the numberOfUnits must also be greater than zero.

- Date Coherence: The issueDate must be less than or equal to the closingDate.

- Coupon Coherence: couponType = ’04’ (zero coupon) must be used in combination with couponFrequency = ’00’ (zero coupon), and vice-versa.

- Date & Frequency Logic: The difference between the closingdate and the couponLastPaymentDate must be coherent with the reported couponFrequency.

3.2. Cross-Report Consistency Checks

This is a critical validation layer that ensures data alignment across different regulatory reports. Discrepancies will result in reporting rejection.

3.2.1. Consistency with S 1.3 / S 2.13 (Balance Sheet Reports)

The totalReportedAmount for each of the five core balance sheet lines in the TPTOBS file must exactly match the corresponding aggregated line item in the S 1.3 / S 2.13 statistical balance sheet reports.

| TPTOBS Item | S 1.3 / S 2.13 Line Item |

|---|---|

| totalReportedAmount for 1-003000 | 1-003000-XX-XXX-90000 |

| totalReportedAmount for 1-005000 | 1-005000-XX-XXX-90000 |

| totalReportedAmount for 2-002050 | 2-002050-XX-XXX-90000 |

| totalReportedAmount for 2-003000 | 2-003000-XX-XXX-90000 |

| totalReportedAmount for 2-004000 | 2-04000XX-XXX-90000 |

3.2.2. Consistency with U 1.1 / S 2.20 (Financial Reports)

Data points related to the fund and its share classes must be perfectly aligned between the TPTOBS and the U 1.1 / S 2.20 reports.

| U 1.1 / S 2.20 Field | TPTOBS Field Correspondence |

|---|---|

| 2030: Base currency of the UCI | reportingCurrency |

| 3020: Total net asset value | totalReportedAmount for line 2-004000 |

| 4040: ISIN code of the unit/share class | code (where codeType is ‘1’) |

| 5010: Number of units/shares outstanding | numberOfUnits |

| 5020: Net asset value per unit/share | reportedAmount / numberOfUnits |

| 5070: Total distributions made | distributedAmount |

4. Mitigating Reporting Complexity with the Fund XP Solution

The TPTOBS framework’s intricate data requirements, coupled with its zero-tolerance policy for errors and inconsistencies, presents a significant operational challenge. Manual data compilation and validation are highly susceptible to error, risking reporting delays, rejections, and increased compliance costs.

The Fund XP solution is engineered to address these challenges directly by embedding the BCL’s complex requirements into a streamlined, automated workflow.

- Structured Data Capture: The solution provides dedicated and intuitive interfaces for both ISIN and non-ISIN securities. This ensures that all mandatory fields, from basic identifiers to the extensive supplementary information required for non-ISIN assets, are systematically captured.

- Pre-emptive Validation Engine: By integrating the BCL’s complete verification rulebook, the Fund XP solution offers real-time validation. As data is entered, the system instantly flags errors, such as an “Invalid ISIN format” or an illogical coupon date combination. This allows for immediate correction at the source, dramatically reducing the likelihood of submission rejection.

- Enhanced Data Integrity: Features such as automated completeness checks ensure that all required attributes for a given security type are provided before the report can be finalized. This systematic approach minimizes the risk of omissions that would otherwise lead to failed submissions.

- Streamlined Reconciliation: The solution is designed to prevent cross-report inconsistencies by facilitating the reconciliation of TPTOBS totals against data prepared for the S 1.3 / S 2.13 and U 1.1 / S 2.20 reports. This ensures that figures align across the entire regulatory reporting spectrum.

By transforming the TPTOBS process from a manual, error-prone task into a controlled and validated workflow, the Fund XP solution empowers financial institutions to meet their regulatory obligations with greater efficiency, accuracy, and confidence.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Fonds_Investissement/Instructions/TPTOBS/index.html