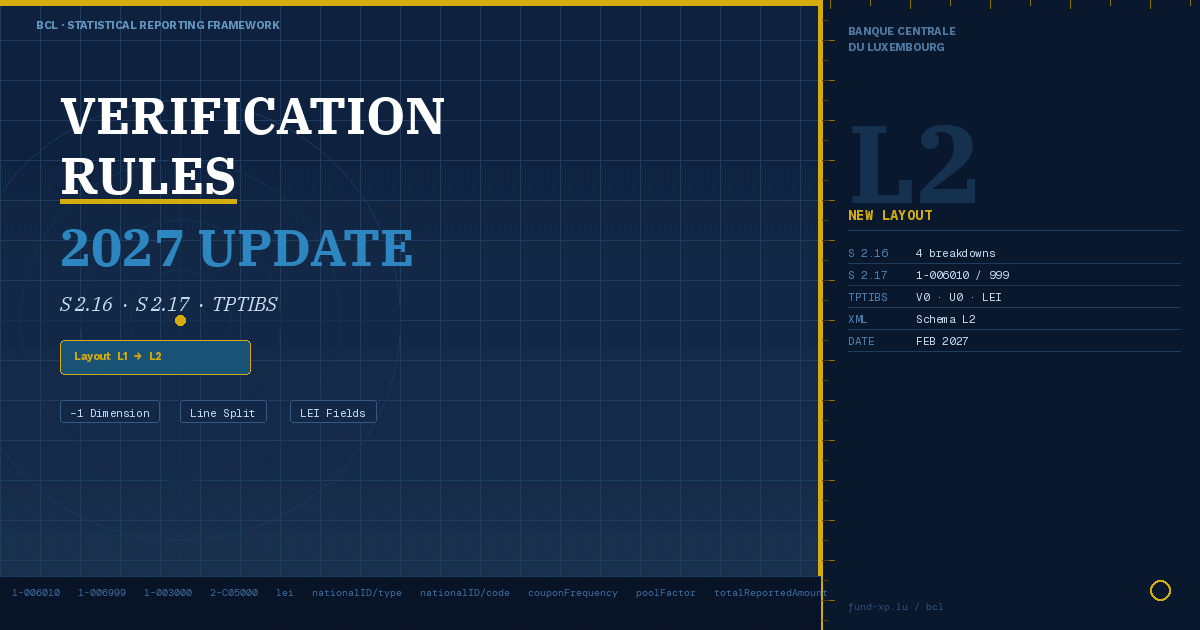

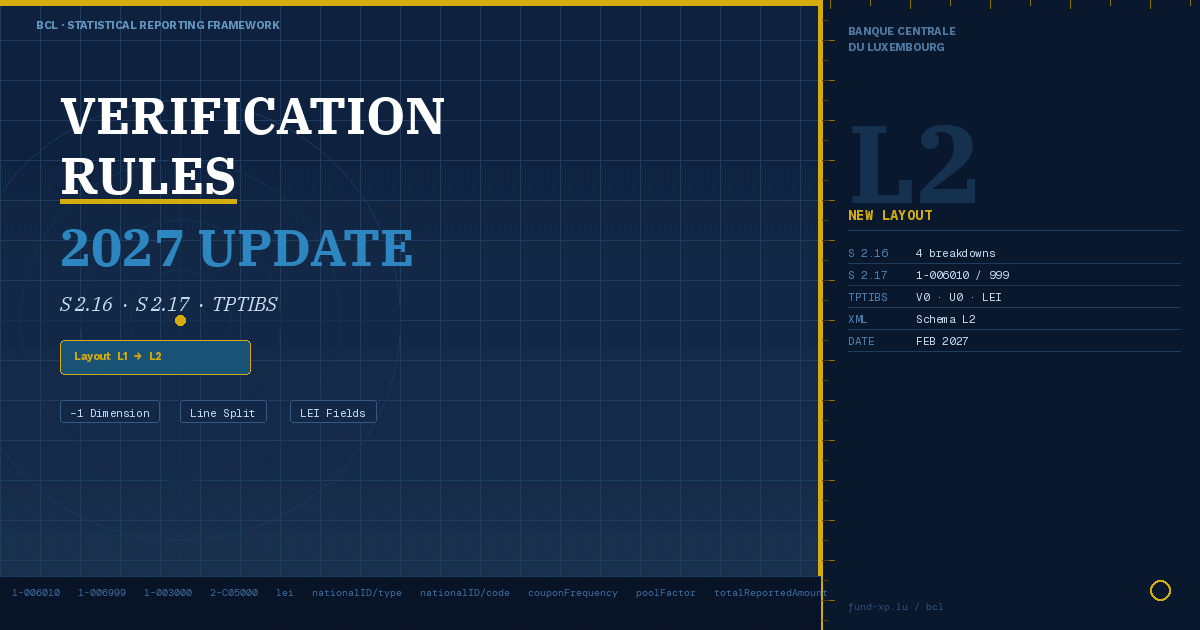

BCL Reporting 2027 : New Rules for Financial Companies

Complete guide to BCL's 2027 reporting update: all verification rule changes for S 2.16, S 2.17 & TPTIBS — Layout L1→L2 migration, breakdown dimensions, XML filenames.

Complete guide to BCL's 2027 reporting update: all verification rule changes for S 2.16, S 2.17 & TPTIBS — Layout L1→L2 migration, breakdown dimensions, XML filenames.

Discover what BCL AnaCredit reporting requires, who is concerned, and how to meet your obligations with the Banque centrale du Luxembourg.

DORA is live — but are you ready for Q1 2026? Discover 5 key lessons on the Register of Information, xBRL-CSV reporting, LEI requirements, and why the spreadsheet era is officially over.

Comprehensive guide to DORA Register of Information (RoI) submission to CSSF for 2026.

Submit your DORA ROI correctly: FiMiS platform guide, xBRL-CSV format requirements, validation feedback, and correction process.

Learn about Luxembourg's CAA circular LC 25/1 on DORA compliance and the DORA Register.

Master CSSF file naming conventions for electronic reporting: Learn the exact formats for COF, DOC, EDP, EME, ESP, FRC, OPC, PSF, SGO, SIC, SUF and OTH reports. Ensure compliance and avoid rejection.

Complete guide to TPT Luxembourg security-by-security reporting for BCL compliance. Learn TPTOBS, TPTIBS, and TPTTBS requirements, validation rules, and critical reconciliation checks for investment funds and financial entities.

BCL Report S 1.6 explained: Learn valuation effects reporting requirements for Luxembourg investment funds. Understand the 5% threshold, calculation methodology, and how to distinguish transactions from price and FX changes.

BCL S 1.3 and S 2.13 reporting guide: Master monthly and quarterly statistical balance sheet requirements for Luxembourg investment funds. Learn data breakdowns, verification rules, and cross-report reconciliation with SBS and S 2.20.