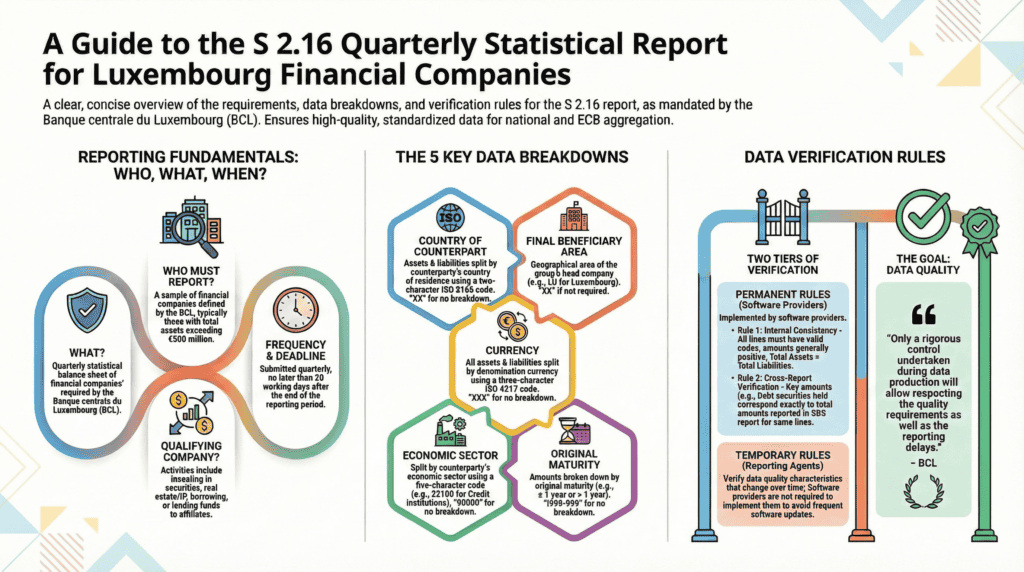

The Banque centrale du Luxembourg (BCL) mandates that a defined sample of financial companies submit the S 2.16 «Quarterly statistical balance sheet of financial companies». This report is a critical component of the statistical data collection framework within Luxembourg and the broader Eurosystem, with data being aggregated by the European Central Bank (ECB). Compliance is mandatory for financial companies with total assets exceeding €500 million.

The core challenge of the S 2.16 report lies in its intricate data requirements. Reporting entities must dissect their balance sheets, breaking down assets and liabilities across five distinct dimensions: country of the counterpart, geographical area of the final beneficiary, currency, economic sector, and original maturity. The BCL has instituted a stringent set of permanent and temporary verification rules to ensure data integrity. These rules include complex internal consistency checks and, critically, require that aggregated figures in the S 2.16 report align precisely with the granular data submitted through Security-by-Security (SBS) reporting.

Failure to meet these exacting standards of quality and timeliness not only risks direct regulatory scrutiny but also carries the potential for “harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.” Given the complexity and reputational risk, manual or underdeveloped reporting processes are insufficient.

The Fund XP solution is engineered to address these challenges directly. It provides a robust, automated framework for generating accurate and compliant S 2.16 reports. By embedding the BCL’s complex breakdown logic and verification rules—including the crucial cross-validation against SBS data—Fund XP mitigates the risk of error, ensures adherence to deadlines, and safeguards an institution’s reputational standing.

Understanding the S 2.16 Reporting Mandate

Objective and Regulatory Authority

The S 2.16 report is a quarterly statistical data collection mandated by the Banque centrale du Luxembourg (BCL). The primary objective is to gather a detailed statistical balance sheet from financial companies operating in Luxembourg. The BCL underscores the critical importance of data quality, stating that “any error or important negligence will have harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.” The collected data undergoes checks by the European Central Bank (ECB) before being aggregated with data from other EU Member States.

Reporting Population and Thresholds

- Who Must Report: The mandate applies to a sample of financial companies defined by the BCL. A company is considered a financial company if its activities include investing, acquiring securities, borrowing, or lending to affiliates.

- Exemption Threshold: A threshold for exemption is fixed at €500 million in total assets (or the equivalent in foreign currency). Companies meeting the definition of a financial company are required to contact the BCL.

- Frequency and Deadline: The report must be submitted on a quarterly basis, no later than 20 working days following the end of the reporting period. The BCL publishes an official schedule for submission.

Core Reporting Requirements: Data Breakdowns

The S 2.16 report requires that assets and liabilities be disaggregated according to a granular, five-criteria framework. While not all balance sheet items require every breakdown, specific lines demand full granularity.

|

Breakdown Criteria

|

Description

|

Key Codes & Remarks

|

|

Country

|

The country of residence or registered office of the counterpart.

|

Uses two-character ISO 3166 codes. Includes specific codes for institutions like the ECB (XA) and EIB (XE). The code XX (No breakdown) is only permitted for non-specified items.

|

|

Geographical Area of Final Beneficiary

|

The geographical area of the parent company that holds final control (head of the group).

|

Identifies four key areas: LU (Luxembourg), X3 (Eurozone ex-LU), X5 (EU non-Eurozone), and X6 (Non-EU). The code XX is used when no breakdown is required.

|

|

Currency

|

The currency in which assets and liabilities are denominated.

|

Uses three-character ISO 4217 codes. The code XXX (No breakdown) is the default for items not requiring a specific currency split.

|

|

Economic Sector

|

The economic sector of the counterparty.

|

Primarily uses two codes: 32100 (Deposit taking corporations – Credit institutions) and 44000 (Captive financial institutions and money lenders), with 44000 as the default. The code 90000 (No breakdown) is used for specified items.

|

|

Original Maturity

|

The original maturity of the reported amounts.

|

Uses two main codes: I000-01A (≤ 1 year) and I01A-999 (> 1 year). The code I999-999 (No breakdown) is the default.

|

A detailed table outlining which breakdowns are required for specific balance sheet items is published on the BCL’s website.

Data Integrity and Verification Rules

The BCL enforces a rigorous set of verification rules to ensure the accuracy and consistency of submitted data. These rules are divided into two categories: permanent and temporary.

Permanent Verification Rules

These rules are constant and software providers are encouraged to implement them directly into their reporting solutions. They consist of two sub-types.

1. Internal Consistency Rules for Report S 2.16

These checks ensure the logical and structural integrity of a single S 2.16 filing.

• Completeness: Every reported line must contain a valid value for all five breakdown criteria (Country, Area, Currency, Sector, Maturity).

• Positive Amounts: All lines must report positive amounts, with specific exceptions for lines 1-003000 (Debt securities held), 1-005000 (Equity and investment fund shares), and 2-C05000 (Capital, reserves, etc.), which may be negative.

• Balance Sheet Equality: The amount reported for Total Assets (1-000000) must precisely match the amount for Total Liabilities (2-000000).

• Use of “No Breakdown” Codes: The specific codes for “No breakdown” (XX ,XXX ,90000 , I999-999) may only be used for the balance sheet lines explicitly permitted in the BCL’s instructions.

2. Cross-Report Consistency Rules: S 2.16 vs. Security-by-Security (SBS) Reporting

This is a critical validation step that requires consistency between the aggregated S 2.16 report and the granular Security-by-Security (SBS) data. The total amounts for specific balance sheet lines in S 2.16 must correspond exactly to the totalReportedAmount for the same identifier in the SBS report.

|

S 2.16 Balance Sheet Line

|

Description

|

Verification Requirement

|

|

1-003000-XX-XXX-90000

|

Debt securities held

|

Must equal the totalReportedAmount for this line in the SBS report.

|

|

1-005000-XX-XXX-90000

|

Equity and investment fund shares/units held

|

Must equal the totalReportedAmount for this line in the SBS report.

|

|

2-002050-XX-XXX-90000

|

Short sales of securities

|

Must equal the totalReportedAmount for this line in the SBS report.

|

|

2-003000-XX-XXX-90000

|

Debt securities issued

|

Must equal the totalReportedAmount for this line in the SBS report.

|

|

2-C05000-XX-XXX-90000

|

Capital, share premiums, reserves and results

|

Must equal the totalReportedAmount for this line in the SBS report.

|

Temporary Verification Rules

These rules address data quality characteristics that may vary over time. They are primarily directed at reporting agents to consider during data preparation, and software providers are not expected to implement them to avoid frequent software updates.

The Fund XP Solution for S 2.16 Compliance

Navigating the complexities of the BCL’s S 2.16 reporting requirements demands a specialized, automated solution. The Fund XP platform is designed to streamline this entire process, ensuring accuracy, timeliness, and full compliance while minimizing the operational burden on financial institutions.

- Automated Data Aggregation and Breakdown: Fund XP automatically processes balance sheet data, applying the BCL’s complex five-criteria breakdown logic. This eliminates the risk of manual errors in classifying assets and liabilities by country, beneficiary, currency, sector, and maturity.

- Embedded Validation Engine: The platform incorporates the BCL’s permanent verification rules. It performs automated internal consistency checks, such as verifying balance sheet equality and ensuring correct code usage, before the report is generated.

- Seamless SBS Reconciliation: Crucially, the Fund XP solution automates the consistency check between the S 2.16 and SBS reports. The system validates that the aggregated totals in S 2.16 precisely match the corresponding totalReportedAmount from the SBS data, addressing a key area of regulatory scrutiny.

- Efficiency and Reliability: By automating the end-to-end reporting workflow, Fund XP drastically reduces the time and resources required for compliance. This ensures that the 20-working-day deadline is met consistently, preventing late submissions and protecting the firm’s reputation.

By leveraging the Fund XP solution, financial companies can transform the S 2.16 mandate from a complex compliance risk into a streamlined, controlled, and efficient operational process.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/