An Analysis of TPTIBS, S 2.16, and S 2.17

The Banque centrale du Luxembourg (BCL) imposes a rigorous and detailed statistical reporting framework on resident financial companies, centered around three key reports:

- Monthly security-by-security report (TPTIBS)

- Quarterly statistical balance sheet (S 2.16)

- Quarterly transactions report (S 2.17)

Compliance is mandatory for financial companies whose total balance sheet assets meet or exceed a threshold of €500 million.

The reporting regime is characterized by its granularity, particularly within the TPTIBS report. This monthly submission requires a comprehensive, line-by-line breakdown of specific security holdings, with significant differentiation in data requirements for securities identified with an ISIN code versus those without.

The complexity is further compounded by the need to apply nuanced rules for:

- Classifying affiliation links within corporate structures

- Correctly identifying the economic holder of a security

The reporting deadlines are stringent, with both monthly (TPTIBS) and quarterly (S 2.16, S 2.17) submissions due within 20 working days following the end of the reference period.

The sheer volume of data, coupled with the complexity of the BCL’s validation rules, presents a substantial operational challenge. This environment necessitates robust, automated solutions capable of aggregating diverse data points, applying complex business logic, and ensuring data integrity for timely and accurate compliance.

Overview of the BCL Reporting Framework

The BCL’s mandate under Regulation 2014/17 requires specific financial entities to submit regular statistical reports. The framework is designed to provide the central bank with a detailed view of the financial sector’s composition and activities.

Reporting Population and Exemption Threshold

Reporting Entities

The obligation applies to resident financial companies, including:

- Legal persons under Luxembourgish law

- Luxembourg-based branches or headquarters of foreign entities

The definition of a financial company is broad and includes entities that:

- Invest in any society

- Acquire securities, bonds, and other financial instruments

- Invest in and manage real estate or intellectual property portfolios

- Borrow in any form or lend funds to shareholders and affiliated companies

Exemption Threshold

The BCL exempts financial companies with a relatively small balance sheet.

- Current exemption threshold: €500 million total balance sheet

- Companies exceeding this threshold must submit the full scope of reports

The Core Statistical Reports

The framework consists of three interconnected reports:

| Report Code | Title | Frequency | Description |

|---|---|---|---|

| TPTIBS | Monthly Security-by-Security Reporting | Monthly | A highly detailed, line-item report of specific security holdings on both the asset and liability sides |

| S 2.16 | Quarterly Statistical Balance Sheet | Quarterly | A standard balance sheet report that provides the foundational figures for the TPTIBS report |

| S 2.17 | Transactions of Financial Companies | Quarterly | A report detailing transactions affecting specific balance sheet items, required under certain conditions |

Compliance note: In any case of discrepancy between the French and English versions of the BCL’s instructional documents, the French text prevails.

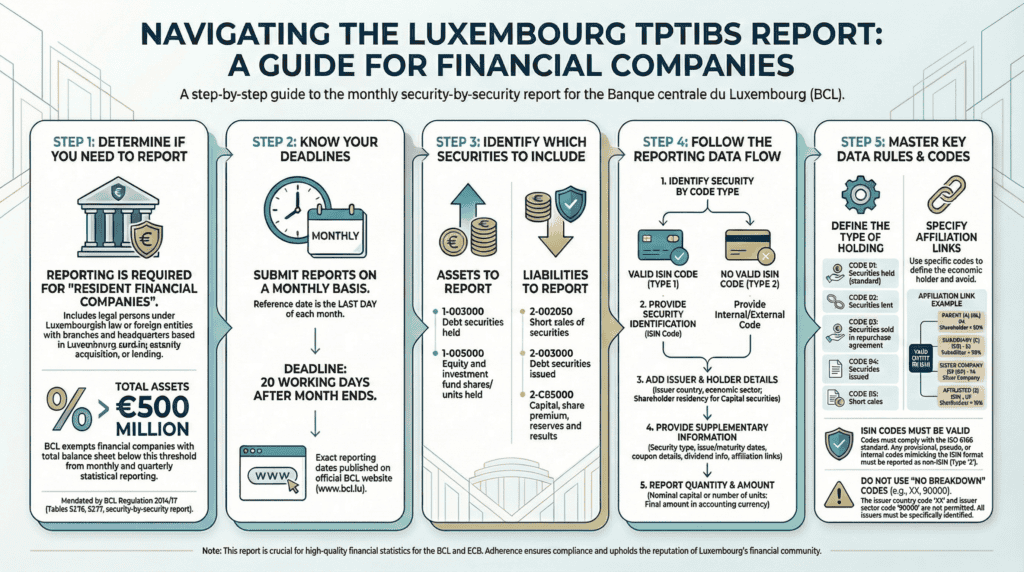

Deep Dive: Report TPTIBS (Monthly Security-by-Security)

The TPTIBS is the most complex and data-intensive of the BCL reports. It requires reporting entities to provide a complete breakdown of individual securities corresponding to specific lines on the S 2.16 balance sheet.

Scope of TPTIBS Reporting

The securities to be included are those reported under the following S 2.16 balance sheet lines.

Assets

- 1-003000: Debt securities held

- 1-005000: Equity and investment fund shares/units held

Liabilities

- 2-002050: Short sales of securities

- 2-003000: Debt securities issued

- 2-C05000: Capital, share premium, reserves and results

Key Reporting Concepts and Classifications

Successful TPTIBS reporting hinges on the correct application of several core concepts defined by the BCL.

Security Identification: ISIN vs. Non-ISIN

A primary distinction is made based on whether a security has a valid ISIN code.

Securities with ISIN (codeType “1”)

- Reporting is streamlined

- ISIN serves as the primary identifier

Securities without ISIN (codeType “2”)

Provisional or pseudo-ISIN codes are not valid and must be reported as non-ISIN. The reporting entity must provide:

- An internal or external unique identifier (e.g. CUSIP, Registre de commerce number for Luxembourg issuers)

- Official security name and currency

- Detailed issuer identification (country and economic sector)

- A full set of supplementary data depending on security type

Affiliation Links

The TPTIBS report requires a detailed breakdown of the relationship between the reporting entity and the counterparty using affiliation link codes.

Asset-Side Codes (U1–U4)

- Differentiate holdings in sister companies based on parent residence:

- Luxembourg

- Eurozone

- EU outside Eurozone

- Outside EU

Liability-Side Codes (V1–V4)

- Classify shares issued by the reporting entity and held by sister companies

Direct & Cross-Holdings

- Direct investments (≥10%)

- Minor cross-holdings (<10%)

- Unaffiliated holdings

Type of Holding (Economic Holder Principle)

The BCL applies the economic holder concept to avoid double counting.

| Code | Type of Holding | Reporting Status |

|---|---|---|

| 01 | Securities held and not affected by temporary transfer | Reported on balance sheet |

| 02 | Securities lent | Reported – lender remains economic holder |

| 03 | Securities sold in a repo | Reported – seller remains economic holder |

| 04 | Securities issued | Reported on liabilities |

| 05 | Short sales of securities | Reported on liabilities |

| – | Securities borrowed / received in a repo | Not reported |

Valuation and Quantity

Valuation

- Quoted securities: prevailing stock exchange price

- Debt securities: dirty price, including accrued interest

Quantity

- Percentage-quoted securities: nominal capital amount and currency

- All others: number of individual securities

Granular Data Requirements of TPTIBS

The information required varies by balance sheet item and by ISIN status.

Common Information Requirements

For every reported security:

- Balance sheet line (item, country XX, currency XXX, economic sector 90000)

- Type of holding code

- Reported amount in reporting currency

- Custodian bank country (XX if no custodian)

Supplementary Information for Non-ISIN Securities

Debt Securities

(Items 1-003000, 2-003000, 2-002050)

| Data Field | Description |

|---|---|

| Issuer Identification | Issuer country and economic sector (XX and 90000 not permitted) |

| Security Type | Code F.3 |

| Issue & Maturity Dates | Full issue date and final maturity date (01.01.2999 for perpetuals) |

| Pool Factor | Percentage of principal remaining (default 1) |

| Coupon Type | 01 fixed, 03 floating, 04 zero coupon, 05 index linked |

| Coupon Frequency | 01 annual, 02 semi-annual, 04 quarterly, 12 monthly |

| Last Coupon Date | Date of last coupon payment |

| Coupon Rate | Annualized rate at reporting date |

Equity & Fund Shares

(Items 1-005000, 2-C05000, 2-002050)

| Data Field | Description |

|---|---|

| Issuer / Holder ID | Issuer country/sector for assets; holder country for liabilities |

| Affiliation Link | Appropriate code (01, U2, 04, V2, etc.) |

| Security Type | F.511, F.512, F.519, or F.52 |

| Dividend Coefficient | (Dividend / Reported Amount) × 100 |

| Last Dividend Date | Full date (default 31.12.2013 if none) |

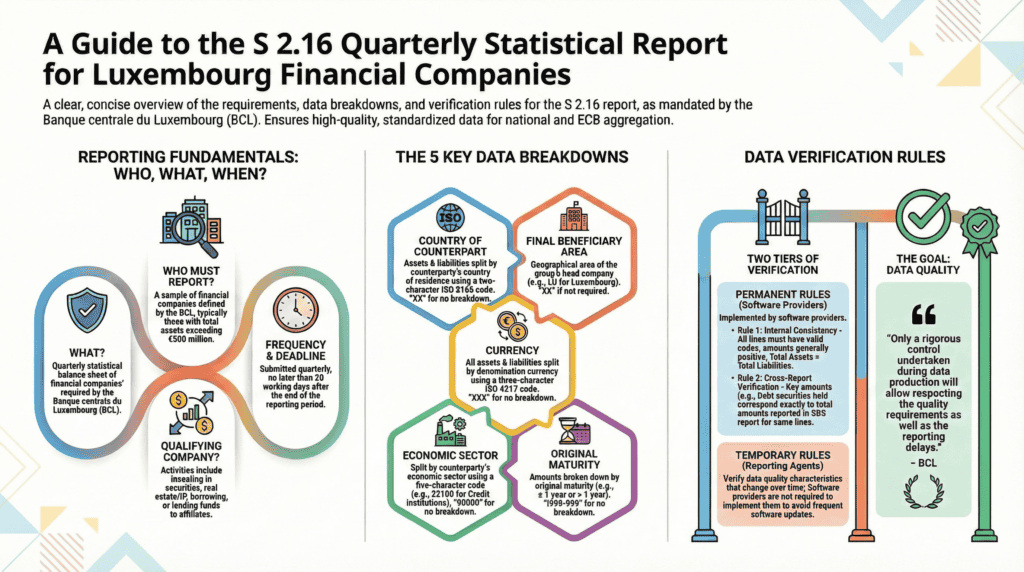

The Supporting Quarterly Reports: S 2.16 & S 2.17

Report S 2.16: Quarterly Statistical Balance Sheet

This report serves as the foundational document.

- Defines the scope of securities for TPTIBS

- TPTIBS totals must reconcile exactly with S 2.16 figures

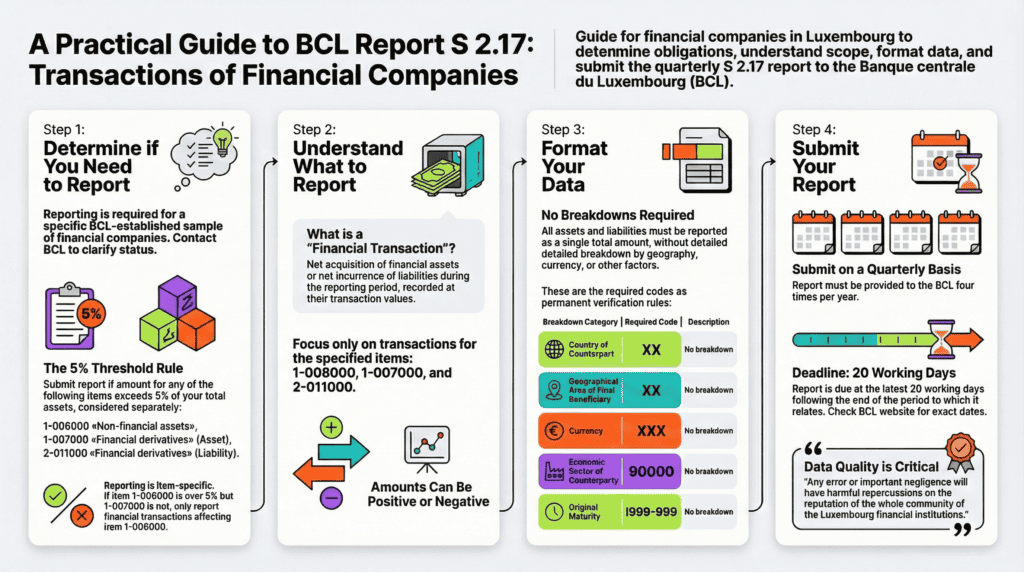

Report S 2.17: Quarterly Transactions of Financial Companies

The purpose of S 2.17 is to capture transactions affecting specific balance sheet items.

Reporting Trigger

- Required only if:

- 1-006000 Non-financial assets, or

- 1-007000 Financial derivatives

- Individually exceed 5% of total assets

Simplified Breakdowns

All dimensions use “No breakdown” codes:

- Country: XX

- Geographical Area: XX

- Currency: XXX

- Economic Sector: 90000

- Original Maturity: I999-999

The Compliance Challenge and the Fund XP Solution

The BCL reporting framework creates significant operational hurdles.

Key Challenges

- Data Aggregation: Consolidating data from multiple systems

- Complex Rule Application: ISIN logic, affiliation links, economic holder rules

- Data Integrity & Reconciliation: Matching TPTIBS details with S 2.16 totals

- Operational Strain: Monthly reporting cycles and tight deadlines

How the Fund XP Solution Can Help

A dedicated regulatory reporting platform can effectively manage these challenges.

Fund XP Key Capabilities

- Automated Data Management

Aggregates and enriches data from multiple sources into a complete reporting dataset - Intelligent Rule Engine

Automatically applies BCL classification logic and ISIN/non-ISIN rules - Integrated Validation

Built-in checks ensure reconciliation and data consistency before submission - Streamlined Workflow

Automates the full process from data collection to report generation

By transforming BCL reporting into a controlled and automated process, the Fund XP solution ensures consistent, accurate, and timely regulatory compliance.

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Societes_financieres/index.html