This document provides a comprehensive analysis of the Banque Centrale du Luxembourg (BCL) statistical report S 1.6, “Information on valuation effects on the balance sheet of investment funds.” The report is a critical component of the Eurosystem’s data collection framework, designed to enhance the accuracy of monetary and financial statistics compiled by the European Central Bank (ECB).

The primary objective of Report S 1.6 is to enable the BCL to distinguish between actual financial transactions and changes in balance sheet positions that arise from non-transactional valuation effects, such as price fluctuations and exchange rate movements. This allows for the calculation of true “flow statistics,” which are essential for economic analysis and research.

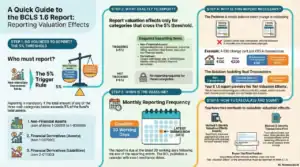

- Mandatory Reporting: The report is mandatory for non-monetary investment funds domiciled in Luxembourg that meet specific asset concentration thresholds.

- Triggering Threshold: Reporting is required for a main asset/liability category when its total value exceeds 5% of the fund’s total assets. The specific categories are Non-financial assets, Financial derivatives (Assets side), and Financial derivatives (Liabilities side).

- Reporting Frequency: S 1.6 must be submitted to the BCL on a monthly basis, with a deadline of 20 working days following the end of the reference period.

- Core Data Point: The report requires funds to provide the net valuation effect—the combined impact of market valuation and exchange rate variations—for the specified balance sheet items during the reporting period.

- Purpose: This data allows the BCL to accurately calculate net financial transactions using the formula:

Net transactions = Change in Stock – Net valuation effects.

The complexity of isolating valuation effects from transactional data presents a significant operational challenge for reporting entities. Solutions such as Fund XP are designed to automate the data aggregation, calculation, and formatting required for S 1.6, mitigating compliance risk and improving operational efficiency.

The Rationale Behind Report S 1.6: Enhancing Flow Statistics

The European Central Bank (ECB) and the broader Eurosystem require precise statistics on both outstanding asset amounts (stocks) and the financial transactions (flows) that occur within a given period. A simple comparison of month-end balance sheets is insufficient, as it fails to account for valuation changes that are not the result of a transaction.

Report S 1.6 is designed to close this information gap for specific asset and liability categories where the BCL cannot independently estimate these effects.

The Core Problem: Distorting Effects of Valuation Changes

Changes in an investment fund’s balance sheet between two reporting dates are driven by two main factors:

- Financial Transactions: The net result of purchases and sales of assets or the issuance and redemption of liabilities.

- Valuation Effects (Non-Transactional): Changes in the accounting value of assets and liabilities due to:

- Price Changes: Fluctuations in the market value of holdings.

- Exchange Rate Changes: Movements in currency exchange rates affecting assets denominated in foreign currencies.

Without isolating valuation effects, the calculated “flow” would be an inaccurate representation of a fund’s actual transactional activity.

The BCL’s Calculation Methodology

The BCL uses the data from Report S 1.6 to refine its statistics. The fundamental relationship is expressed as:

Closing Stock = Opening Stock + Net Transactions + Net Valuation Effects

Therefore, to calculate the true flow of transactions, the formula is rearranged:

Net Transactions = Closing Stock – Opening Stock – Net Valuation Effects

Illustrative Example

Consider a fund’s holding in “Non-financial assets – Real estate – Residential”:

| Metric | Value |

|---|---|

| Stock as at 31.01.2026 | 120 |

| Stock as at 28.02.2026 | 200 |

| Total Variation in Stock | +80 |

This variation of 80 is composed of:

- Net balance of purchases and sales (Transactions): 50

- Net valuation effect (Price/FX changes): 30

The amount to be declared in Report S 1.6 is 30. This allows the BCL to accurately calculate the real transaction flow:

200 – 120 – 30 = 50

Detailed Reporting Requirements

Reporting Population and Triggering Conditions

The obligation to file Report S 1.6 applies to non-monetary investment funds (or their compartments). The requirement is triggered when the total value of assets or liabilities within one of the specified main categories exceeds 5% of the fund’s total assets as reported in the monthly or quarterly statistical balance sheet.

The BCL actively monitors these thresholds. Reporting is mandatory for any of the following categories that meet the 5% rule:

- Non-financial assets: The sum of all items from 1-006011 to 1-006999.

- Financial derivatives – Assets side: Item 1-007000.

- Financial derivatives – Liabilities side: Item 2-011000.

If a fund’s non-financial assets exceed 5% of total assets but its derivatives do not, it must only report the valuation effects for the specific non-financial asset items.

Frequency and Submission Deadlines

- Frequency: Monthly

- Deadline: At the latest, 20 working days following the end of the reporting month.

- Calendar: The BCL publishes an official calendar with all remittance dates on its website.

Scope: Specific Balance Sheet Items

Valuation effects must be reported for the following specific balance sheet items, provided their parent category has crossed the 5% threshold.

| Main Category | Item Code | Item Description |

|---|---|---|

| Non-financial assets | 1-006011 | Non-financial assets – Real estate – Residential |

| 1-006012 | Non-financial assets – Real estate – Commercial | |

| 1-006013 | Non-financial assets – Real estate – Industrial | |

| 1-006014 | Non-financial assets – Real estate – Offices | |

| 1-006015 | Non-financial assets – Real estate – Others | |

| 1-006999 | Non-financial assets – Other non-financial assets | |

| Financial derivatives – Assets side | 1-007000 | Financial derivatives |

| Financial derivatives – Liabilities side | 2-011000 | Financial derivatives |

Calculation and Reporting Methodology

The BCL allows reporting entities flexibility in how they derive the required data. Funds can choose the method that best aligns with their internal accounting and data systems:

- Direct Identification: Specifically identify and aggregate the impact of all price and exchange rate changes for each relevant asset and liability. This can be complex but is a direct approach.

- Indirect Calculation (Transaction-Based): Identify all financial transactions (purchases/sales) during the period. The valuation effect can then be calculated as the residual amount needed to reconcile the opening and closing balances.

Regardless of the internal method used, the final figure submitted in Report S 1.6 must represent the net valuation effect that occurred during the reference period.

The Fund XP Solution for S 1.6 Reporting

The operational demands of BCL S 1.6 reporting—including threshold monitoring, data segregation, complex calculations, and specific formatting—create a significant compliance burden. Specialized regulatory reporting solutions are essential for ensuring accuracy and efficiency.

The Fund XP platform provides a streamlined, automated solution specifically designed to address the challenges of BCL reporting.

Key Capabilities

- Automated Threshold Monitoring: The system can automatically ingest balance sheet data to monitor the 5% thresholds for non-financial assets and derivatives, flagging when an entity comes into scope for S 1.6 reporting.

- Targeted Data Extraction: Fund XP identifies and isolates the specific balance sheet items required for the report, ensuring that only relevant data is processed.

- Robust Calculation Engine: The platform is equipped to perform the necessary calculations to determine the net valuation effect, whether through direct identification of valuation changes or by deriving it from transactional data.

- Compliance-Ready Formatting: As illustrated by its reporting templates, Fund XP generates the S 1.6 report in the precise format required by the BCL, populating fields for each item code with the calculated valuation effect. This eliminates manual formatting errors and ensures seamless submission.

- Reduced Operational Risk: By automating the end-to-end reporting process, Fund XP minimizes the risk of human error, ensures timely submission, and provides a clear audit trail for compliance purposes.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Fonds_Investissement/Instructions/S0106/index.html