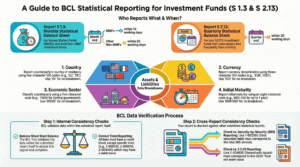

This briefing provides a comprehensive analysis of the statistical reporting requirements set forth by the Banque Centrale du Luxembourg (BCL) for reports S 1.3 and S 2.13. These reports, which detail the monthly and quarterly statistical balance sheets for Money Market Funds (MMFs) and non-MMF investment funds, are critical components of the data collection framework within the Eurosystem.

The core challenge for reporting entities lies in the complexity of the BCL’s verification rules. These rules mandate not only strict internal consistency within the reports but also cross-report validation against Security by Security (SBS) and S 2.20 reporting. The BCL emphasizes that data quality is paramount, stating that “any error or important negligence will have harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.”

Adherence to these intricate requirements—including precise data breakdowns by country, currency, economic sector, and maturity—demands rigorous control during data production. The Fund XP solution is designed to address this challenge by providing a platform for automated reconciliation and discrepancy analysis. By systematically comparing report data against other sources, such as TPT, the solution enables the identification and correction of errors prior to submission, thereby ensuring compliance, mitigating risk, and upholding data integrity.

1. Overview of BCL Statistical Balance Sheet Reporting

The Banque Centrale du Luxembourg, as part of the Eurosystem, mandates the submission of statistical balance sheets from investment funds to facilitate data aggregation and analysis by the European Central Bank (ECB). The two primary reports are:

- Report S 1.3: “Monthly statistical balance sheet” for MMFs and most non-MMF investment funds.

- Report S 2.13: “Quarterly statistical balance sheet” for specific non-UCITS investment funds with less frequent asset valuation.

The BCL underscores the importance of data quality, requiring reporting institutions to perform rigorous controls to avoid delays and reputational damage.

1.1. Reporting Population and Deadlines

The obligation to report and the associated frequency are determined by the fund type and its asset valuation schedule.

| Report | Fund Type | Frequency | Deadline |

|---|---|---|---|

| S 1.3 | Money Market Funds (MMFs) | Monthly | 10 working days following the end of the period |

| S 1.3 | Non-MMF investment funds (excluding those below) | Monthly | 20 working days following the end of the period |

| S 2.13 | Non-UCITS investment funds with asset valuation less frequent than monthly | Quarterly | 20 working days following the end of the period |

2. Core Reporting Requirements: Data Breakdowns

Assets and liabilities must be disaggregated according to four specific criteria. The BCL provides detailed nomenclature and codes for this purpose.

2.1. Country Breakdown

Assets and liabilities are split by the counterparty’s country of residency using a two-character ISO code. Specific codes are designated for international and European institutions (e.g., XA for the ECB). For items where no country breakdown is required, the code XX must be used.

2.2. Currency Breakdown

Data must be split by the currency of denomination using a three-character ISO code. Where no currency breakdown is requested, the code XXX is used.

2.3. Economic Sector Breakdown

Counterparties must be classified using a five-character economic sector code. The designated code for items not requiring a breakdown is 90000.

| Code | Label |

|---|---|

| 11000 | Central government |

| 12100 | State government |

| 12200 | Local government |

| 12300 | Social security funds |

| 21000 | Non-financial corporations |

| 22110 | Households – Employers and own-account workers |

| 22120 | Households – Physical persons |

| 22200 | Non-profit institutions serving households |

| 31000 | Central bank |

| 32100 | Credit institutions |

| 32200 | Other deposit taking corporations |

| 33000 | Money market funds (MMF) |

| 41000 | Non MMF investment funds |

| 42100 | Securitisation vehicles |

| 42200 | Central counterparties |

| 42900 | Other financial intermediaries |

| 43000 | Financial auxiliaries |

| 44000 | Captive financial institutions and money lenders |

| 45000 | Insurance corporations |

| 46000 | Pension funds |

2.4. Initial Maturity Breakdown

Reported amounts must be broken down by initial maturity using an eight-character code. The designated code for items not requiring a breakdown is I999-999.

| Code | Initial Maturity |

|---|---|

| I000-01A | Up to 1 year |

| I01A-02A | Over 1 and up to 2 years |

| I02A-05A | Over 2 and up to 5 years |

| I05A-999 | Over 5 years |

3. The Challenge: BCL’s Verification Rules

The BCL applies a multi-layered verification process to ensure data integrity. These checks are performed after data is received and are categorized as internal rules and cross-report consistency rules.

3.1. Internal Verification Rules

These rules apply to the structure and content within a single S 1.3 or S 2.13 report:

- Completeness: A valid value for all four breakdowns (country, currency, sector, maturity) must be provided for each line.

- Balance Sheet Equation: The total assets reported in line 1-000000 must exactly match the total liabilities in line 2-000000.

- Credit/Debit Trend: All lines must have a credit trend, except for specific liability lines (1-090010, 2-090010, 2-004000) which may have a debit trend.

- Use of “No Breakdown” Codes: The special codes (XX, XXX, 90000, I999-999) may only be used for the specific balance sheet lines authorized in the BCL’s instructions.

- Conditional Rules: Certain codes are conditional. For example, the economic sector code 12100 (State government) may only be used with country codes of nations that have a federal structure.

3.2. Cross-Report Consistency Rules

The BCL mandates that data in the S 1.3 / S 2.13 reports must be consistent with figures submitted in other regulatory reports.

Verification against Security by Security (SBS) Reporting:

The total amounts for several key asset and liability lines in the S 1.3 / S 2.13 reports must correspond to the totalReportedAmount for the same balance sheet identifiers in the SBS reporting. This applies to:

- 1-003000: Debt securities held

- 1-005000: Equity and investment fund shares/units held

- 2-002050: Borrowings – Short sales of securities

- 2-003000: Debt securities issued

- 2-004000: Shares/units issued

Verification against S 2.20 Reporting:

A specific consistency check links the balance sheet to the S 2.20 report:

- The amount in line 2-004000 (Shares/units issued) in the S 1.3 / S 2.13 reports must correspond to the Total net asset value of the reference for line 3020 in the S 2.20 report.

4. Streamlining Compliance: The Fund XP Solution

The complexity and interdependence of the BCL’s verification rules present a significant operational challenge. The Fund XP solution is engineered to directly address these requirements by providing an automated control and reconciliation framework.

- Automated Cross-Report Reconciliation: The platform facilitates the necessary verification checks mandated by the BCL. As shown in its S 1.3 Vs TPT and S 2.13 Vs TPT modules, the solution compares balance sheet items against granular data sources (like TPT, which informs SBS reporting) to ensure alignment.

- Discrepancy Identification: The system is designed to highlight inconsistencies automatically. The inclusion of a “Delta” column in its reporting interface immediately flags any variance between the statistical balance sheet figures and the underlying security data. For example, a delta can be shown for item 1-005000: Equity and investment fund shares/units held, pinpointing the exact location of a mismatch.

- Pre-Submission Quality Control: By running these checks before the data is transmitted to the BCL, the Fund XP solution enables reporting entities to proactively identify and rectify errors. This internal control mechanism is crucial for meeting the BCL’s stringent quality requirements, avoiding reporting delays, and safeguarding the institution’s reputation within the Luxembourg financial community and the broader Eurosystem.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Fonds_Investissement/Instructions/S0103_S0213/index.html