A Briefing on S 2.14, S 2.15, and TPTTBS Reports

The Banque centrale du Luxembourg (BCL), in alignment with European Central Bank (ECB) directives, has established a multi-layered statistical reporting framework for Securitisation Vehicles (SVs). This framework is designed to provide comprehensive data on SV assets, liabilities, and transactions for analytical and research purposes.

Compliance requires the submission of three distinct, interconnected reports:

- Monthly TPTTBS – Security-by-Security Report

- Quarterly S 2.14 – Statistical Balance Sheet

- Quarterly S 2.15 – Transactions and Write-offs / Write-downs Report

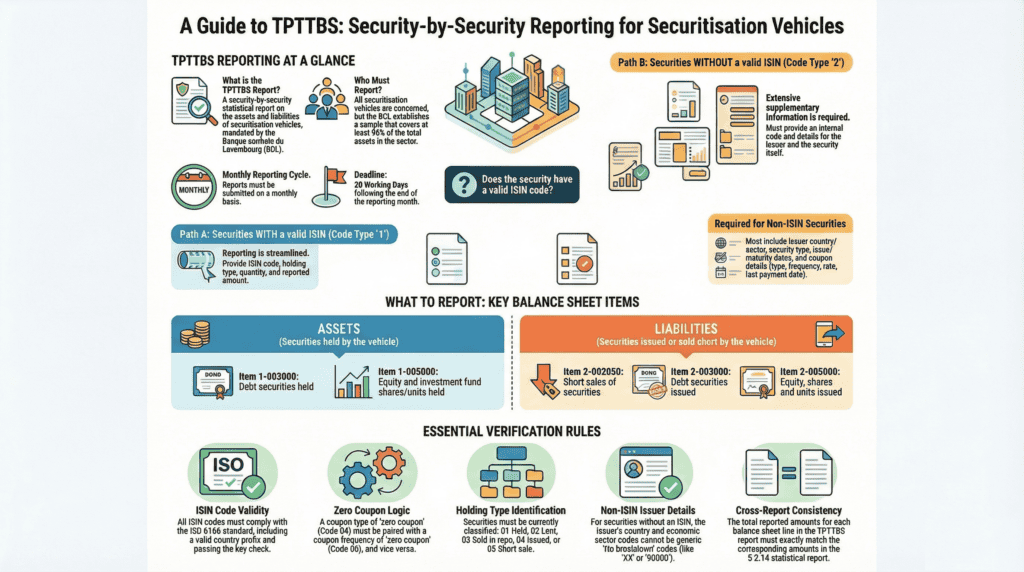

The primary operational challenge lies in the extreme complexity and granularity of these requirements, particularly within the TPTTBS report. A critical distinction is made between securities identified by an ISIN code and those without, with non-ISIN securities requiring a significant volume of supplementary data, including issuer details and coupon characteristics.

Reporting entities face strict deadlines, with both monthly and quarterly reports due within 20 working days of period end. The intricate validation rules and reconciliation requirements across reports create a substantial compliance burden. An automated and specialized solution, such as Fund XP, is essential to manage data aggregation, enrichment, validation, and submission efficiently.

1. Overview of the BCL Reporting Framework

The BCL’s statistical reporting regime for SVs is governed by ECB Regulation (EU) No 1075/2013.

The framework mandates data collection from a representative sample of securitisation vehicles selected by the BCL to account for at least 95% of total SV assets in Luxembourg. The obligation applies to all SVs, regardless of:

- Legal form

- Supervision by the Commission de Surveillance du Secteur Financier (CSSF)

Core Statistical Reports

The reporting structure consists of three core reports, each providing a different level of insight into an SV’s financial position and activities.

| Report Name | BCL Code | Frequency | Deadline | Core Function |

|---|---|---|---|---|

| Security-by-security reporting of securitisation vehicles | TPTTBS | Monthly | 20 working days post month-end | Granular, position-level detail for security holdings and issuances |

| Quarterly statistical balance sheet of securitisation vehicles | S 2.14 | Quarterly | 20 working days post quarter-end | Aggregated balance sheet overview |

| Transactions and write-offs/write-downs on securitised loans | S 2.15 | Quarterly | 20 working days post quarter-end | Net transactions and loan valuation adjustments |

Interconnection of Reports

- TPTTBS data must reconcile with S 2.14 aggregated balances

- S 2.15 explains movements between balance sheet reporting dates

2. Deep Dive into Reporting Requirements

2.1 Report TPTTBS – The Granular Core

The TPTTBS report is the most detailed and operationally intensive component of the framework. It requires a line-by-line declaration of specific asset and liability positions.

Scope of Reporting

Assets

- 1-003000: Debt securities held

- 1-005000: Equity and investment fund shares/units held

Liabilities

- 2-002050: Short sales of securities

- 2-003000: Debt securities issued

- 2-005000: Equity, shares and units issued

ISIN vs. Non-ISIN Securities

The central complexity of the TPTTBS report is the strict bifurcation based on the availability of a valid ISIN code.

Securities with a Valid ISIN (Code Type “1”)

Reporting is comparatively streamlined and includes:

- Identification: ISIN code

- Holding type:

- 01 – Standard holdings

- 02 – Securities lent

- 03 – Repo sales

- 04 – Securities issued

- 05 – Short sales

- Quantity:

- Nominal amount for percentage-quoted securities

- Number of units for currency-quoted securities

- Valuation:

- Reported at market value

- Debt securities valued using the dirty price (including accrued interest)

- Custodian: ISO country code of the custodian bank

Securities without a Valid ISIN (Code Type “2”)

When no valid ISIN exists (including provisional or pseudo-ISINs), extensive supplementary information is mandatory.

Common Requirements

- Internal security identifier

- Security name and currency

- Issuer country and economic sector

- “No breakdown” codes XX and 90000 are not permitted

Supplementary Data for Non-ISIN Debt Securities (Type “F.3”)

| Data Point | Description |

|---|---|

| issueDate | Full issue date |

| finalMaturityDate | Final maturity date (01.01.2999 for perpetuals) |

| poolFactor | Percentage of principal remaining (default 1) |

| couponType | Fixed, floating, zero coupon, etc. |

| couponFrequency | Annual, semi-annual, monthly, etc. |

| couponLastPaymentDate | Date of last coupon payment |

| couponRate | Annualized rate at reporting date |

Supplementary Data for Non-ISIN Equity / Fund Shares

(Types F.511, F.512, F.519, F.52)

| Data Point | Description |

|---|---|

| securityType | Equity or fund classification |

| dividendAmount | Dividend as % of reported amount (issued equity) |

| dividendLastPaymentDate | Date of last dividend payment |

| splitDate | Date of split or reverse split |

| splitRatio | Split (>1) or reverse split (0–1) ratio |

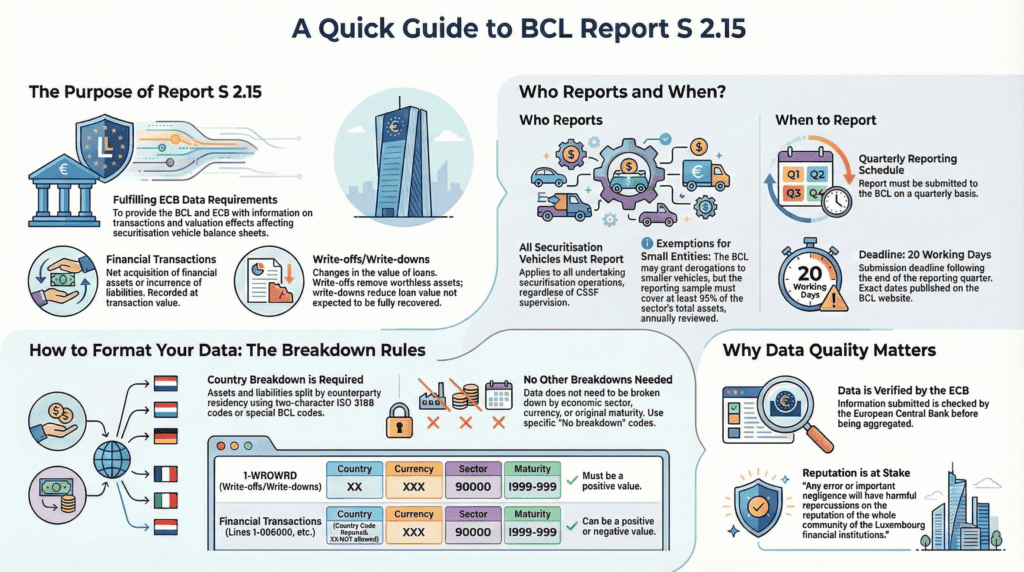

2.2 Report S 2.15 – Tracking Quarterly Changes

The S 2.15 report captures movements during the quarter, distinguishing between transactions and valuation effects.

Financial Transactions

Definition:

Net acquisition of financial assets or net incurrence of liabilities, recorded at transaction value.

Applicable Items

- 1-006000: Non-financial assets

- 1-007000: Financial derivatives (assets)

- 1-011020 / 1-011040 / 1-011090: Other securitised assets

- 2-011000: Financial derivatives (liabilities)

Materiality threshold:

Valuation effects are required only if an item exceeds 5% of total SV assets.

Write-Offs and Write-Downs on Securitised Loans

Applies to securitised loans recorded under 1-010010 to 1-010060.

- Write-downs: Partial impairment of loan value

- Write-offs: Full removal of a loan deemed worthless

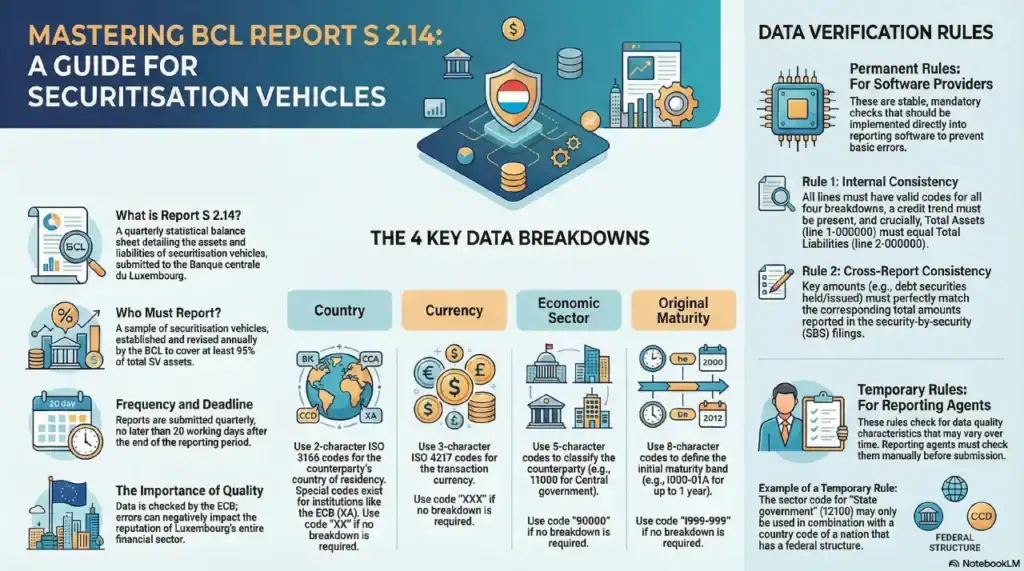

2.3 Report S 2.14 – The Aggregate Balance Sheet

The S 2.14 report provides a quarterly, high-level statistical balance sheet.

Breakdown Requirements

- Required:

- Assets and liabilities by counterparty country

- ISO 3166 codes and specific BCL institutional codes

- Not required:

- Currency → XXX

- Economic sector → 90000

- Original maturity → I999-999

3. The Fund XP Solution – Streamlining BCL Compliance

The complexity, frequency, and interdependence of BCL reporting requirements create substantial operational risk when managed manually.

Fund XP provides a dedicated, automated regulatory reporting platform designed specifically to address these challenges.

How Fund XP Mitigates Compliance Risk

Centralized Data Hub

- Aggregates data from portfolio, accounting, and custody systems

- Eliminates spreadsheet-based consolidation

Intelligent Data Enrichment

- Manages extensive non-ISIN data requirements

- Rule-based capture of issuer, coupon, and maturity data

Automated Validation Engine

- Applies BCL validation rules automatically

- Ensures reconciliation between TPTTBS and S 2.14

- Verifies codes, formats, and report structure

Workflow and Reporting Automation

- Manages monthly and quarterly reporting calendars

- Generates XML reports for electronic submission

- Maintains full audit trails for regulatory review

By leveraging Fund XP, reporting entities can transform BCL compliance from a high-risk, resource-intensive obligation into a controlled, automated, and reliable process—ensuring timely submissions while freeing operational resources for core business activities.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Vehicules_de_titrisation/index.html