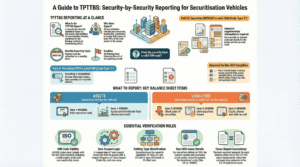

The Banque centrale du Luxembourg (BCL) mandates a rigorous and highly detailed monthly security-by-security (SBS) data collection, known as report TPTTBS, for all securitisation vehicles. This reporting framework is characterized by its complexity, stringent data quality requirements, and a comprehensive set of validation rules designed to ensure absolute accuracy. Reporting entities face a tight deadline of 20 working days post-period end to submit error-free files.

The BCL explicitly warns that “Any error or important negligence will have harmful repercussions on the reputation of the whole financial community in Luxembourg,” underscoring the critical nature of compliance. The data undergoes a dual-verification process, first by the BCL and subsequently by the European Central Bank (ECB), magnifying the need for precision. Key challenges include managing the distinction between securities with and without valid ISIN codes, providing extensive supplementary data for non-ISIN instruments, and ensuring consistency between the TPTTBS report and the S 2.14 statistical balance sheet.

Successfully navigating this regulatory landscape demands a robust and automated approach. The Fund XP solution is engineered to address these challenges directly by embedding the BCL’s complex validation logic into a streamlined workflow. It automates data integrity checks, manages the nuanced requirements for different security types, and ensures cross-report reconciliation, thereby mitigating compliance risk and safeguarding an entity’s operational integrity and reputation within the Luxembourg financial ecosystem.

1. What Is the TPTTBS Reporting Mandate?

The TPTTBS report is a foundational component of the BCL’s statistical data collection for securitisation vehicles, governed by Regulation (EU) n° 1075/2013 (ECB/2013/40). Its purpose is to gather granular, security-level data on the assets and liabilities of these entities.

1.1 Who Must Report and How Often?

-

Reporting Entities: The mandate applies to all securitisation vehicles, irrespective of their legal status or supervision by the Commission de Surveillance du Secteur Financier (CSSF). The BCL establishes and revises annually a sample of reporting vehicles that must collectively account for at least 95% of the total assets held by all securitisation vehicles in Luxembourg.

-

Frequency and Deadline: Reports must be provided to the BCL on a monthly basis. The submission deadline is no later than 20 working days following the end of the reference month.

1.2 Which Securities Fall Within the Scope of TPTTBS Reporting?

The TPTTBS report requires a detailed breakdown of securities that correspond to specific lines on the S 2.14 statistical balance sheet.

Balance Sheet Mapping

| Balance Sheet | Line Identifier | Description |

|---|---|---|

| Assets | 1-003000 | Debt securities held |

| Assets | 1-005000 | Equity and investment fund shares/units held |

| Liabilities | 2-002050 | Short sales of securities |

| Liabilities | 2-003000 | Debt securities issued |

| Liabilities | 2-005000 | Equity, shares and units issued |

2. How Does the BCL Ensure Data Quality and Verification?

The BCL places extreme importance on the quality of submitted data, stating that “Only rigorous control during the entire data production cycle will enable respecting the quality requirements as well as reporting delays.” The verification framework is multifaceted, comprising rules that are both permanent and temporary, as well as internal and cross-report checks.

2.1 Permanent vs. Temporary Rules

-

Permanent Verification Rules: These rules are static and are expected to be implemented directly by software providers into their reporting solutions. They form the core of the data validation logic.

-

Temporary Verification Rules: These rules may vary over time and are primarily addressed to the reporting agents themselves. An example is the rule that sector code 12100 (State government) may only be used for countries with a federal state structure.

2.2 Cross-Report Consistency with S 2.14

A critical component of the validation process is ensuring that the aggregated totals within the TPTTBS report perfectly match the corresponding line items in the S 2.14 statistical report. For example, the totalReportedAmount for balance sheet line 1-003000-XX-XXX-90000 in the TPTTBS file must be identical to the amount reported for that line in the S 2.14 filing. This applies to all five reportable balance sheet lines.

3. What Makes TPTTBS Reporting So Complex?

The intricacy of the TPTTBS report lies in the granular data required for each security, with a significant divergence in requirements based on the availability of a valid ISIN code.

3.1 Security Identification: The ISIN Imperative

The primary identifier for a security is its International Securities Identification Number (ISIN) compliant with the ISO 6166 standard.

-

Securities with ISIN (codeType = 1): Reporting is streamlined, as many security characteristics are derived from the ISIN itself.

-

Securities without ISIN (codeType = 2): The reporting burden increases substantially. This category includes securities with internal codes as well as those with provisional and/or pseudo ISIN codes, which the BCL explicitly states must not be treated as valid ISINs.

For each security reported without a valid ISIN, a comprehensive set of “supplementary information” must be provided.

3.2 Core Data Attributes

Every security entry, regardless of type, requires a set of common data points:

-

Balance Sheet Line (reportedLine): The full identifier corresponding to the S 2.14 report (e.g., 1-003000-XX-XXX-90000).

-

Type of Holding (holdSecurityType): A critical code to prevent double-counting.

Type of Holding Codes

| Code | Type of Holding |

|---|---|

| 01 | Securities held and not affected by a temporary transfer |

| 02 | Securities lent |

| 03 | Securities sold in a repurchase agreement |

| 04 | Securities issued |

| 05 | Short sales of securities |

-

Quantity: Reported either as nominalAmount (for percentage-quoted securities) or numberOfUnits (for currency-quoted securities).

-

Reported Amount (reportedAmount): The value in the balance sheet’s accounting currency, calculated using the “dirty price” (including accrued interest).

3.3 Detailed Validation Rules and Supplementary Data

The BCL’s compendium lists numerous specific validation checks that must be passed. Failure on any of these points can result in report rejection.

Key Validation Examples

-

For a security quoted in percentage points, if reportedAmount > 0, then nominalAmount must also be > 0.

-

ISIN codes must be structurally valid, and the first two characters must be a valid country code (per ISO 3166) or a designated supranational code (e.g., XS). Codes like XX or ZZ are invalid.

-

For securities issued by resident securitisation vehicles without an ISIN, the issuer country must be LU and the issuer sector must be 42100.

-

The issueDate must be less than or equal to the closingDate.

-

The coupon type zero coupon (couponType = 04) can only be used with the coupon frequency zero coupon (couponFrequency = 00), and vice versa.

Supplementary Data for Non-ISIN Debt Securities (F.3)

-

Issuer Identification: Country and economic sector.

-

Dates: issueDate and finalMaturityDate (perpetual bonds use 01.01.2999).

-

Pool Factor: Percentage of principal remaining to be paid; defaults to 1 if not applicable.

-

Coupon Details: couponType, couponFrequency, couponLastPaymentDate, and couponRate.

Supplementary Data for Non-ISIN Equity/Shares (F.511, F.512, F.519, F.52)

-

Issuer Identification: Country and economic sector.

-

Security Type: Must specify if quoted shares, unquoted shares, other equity, or investment fund units.

-

For Issued Equity: dividendAmount (as % of reported amount), dividendLastPaymentDate, splitDate, and splitRatio.

4. How Does Fund XP Automate Compliance and Reduce Regulatory Risk?

The sheer volume of data points, coupled with the BCL’s exhaustive and unforgiving validation framework, makes manual preparation of the TPTTBS report an extremely high-risk, resource-intensive task. The Fund XP solution is purpose-built to automate this complex process and ensure first-time accuracy.

-

Automated Validation Engine: Fund XP embeds the BCL’s complete set of permanent verification rules. The platform automatically checks data for internal consistency—such as the relationship between coupon type and frequency or the coherence between dates—flagging errors in real-time before submission is attempted.

-

Intelligent Data Management: The solution intelligently distinguishes between securities with valid ISINs and those without. For non-ISIN instruments, it dynamically prompts for and validates all required supplementary information, ensuring that every submission is complete and compliant with BCL requirements for debt, equity, and issued shares.

-

Cross-Report Reconciliation: Fund XP seamlessly integrates with S 2.14 statistical reporting data. It performs automated reconciliation checks to guarantee that the totalReportedAmount for each balance sheet line in the TPTTBS file perfectly aligns with the S 2.14 report, eliminating a common source of submission failure.

-

Streamlined and Auditable Workflow: By automating the entire data production cycle—from ingestion and validation to generation of the final XML file—Fund XP dramatically reduces the manual burden on reporting teams. This allows entities to meet the stringent 20-working-day deadline with confidence, backed by a fully auditable trail that supports a “rigorous control” environment as demanded by the BCL.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website: https://www.bcl.lu/en/Regulatory-reporting/Vehicules_de_titrisation/Instructions/TPTTBS/index.html