CRS reporting – Features

- Ergonomic XLS spreadsheets based

- Automatic production based on extracts.

We build reports using complete automatic processes and automated validation checks. We stay up-to-date with the latest specifications, ensuring that our software reflects any changes or updates. This way, your reports are always compliant with the current regulatory standards.

Optionally, we can act as a technical sender and do the filing to the authorities.

-

SCALABILITY AND FLEXIBILITY

The FUND XP solution is able to automate the process of gathering and organizing the required information from multiple sources.

-

ACCURACY

Robust controls in place to prevent errors or omissions.

-

FLEXIBILITY

The solution is able to handle multiple jurisdictions reporting formats.

-

TIMELINESS

Our fully automatic solution enables AIFMs to meet the required reporting deadlines.

-

USER FRIENDLY

The solution is easy for users to understand and use, with clear instructions and intuitive interfaces.

-

SUPPORT

Free adequate support and helpdesk.

What is FATCA CRS reporting?

CRS (Common Reporting Standard) reporting is a global standard for the automatic exchange of financial account information between tax authorities of different countries. Similar to FATCA, CRS aims to combat tax evasion by ensuring that financial account information is reported to the relevant tax authorities, thus enabling them to identify and address cases of undeclared offshore assets and income.

Under CRS, financial institutions in participating countries are required to collect certain information about their account holders, including individuals and entities, and report this information to their local tax authorities. This information includes details such as account balances, interest, dividends, and other income earned on financial accounts held by non-residents.

The tax authorities then exchange this information with the tax authorities of other participating jurisdictions on an annual basis, allowing each country to identify and tax income earned by their residents from foreign financial assets.

CRS NIL reporting

Luxembourg Reporting Financial Institutions are required to communicate a zero value message (ZeroReporting) when they do not have Reportable Accounts.

We can provide cost efficient solution to produce your Zero reporting including the filing to the ACD.

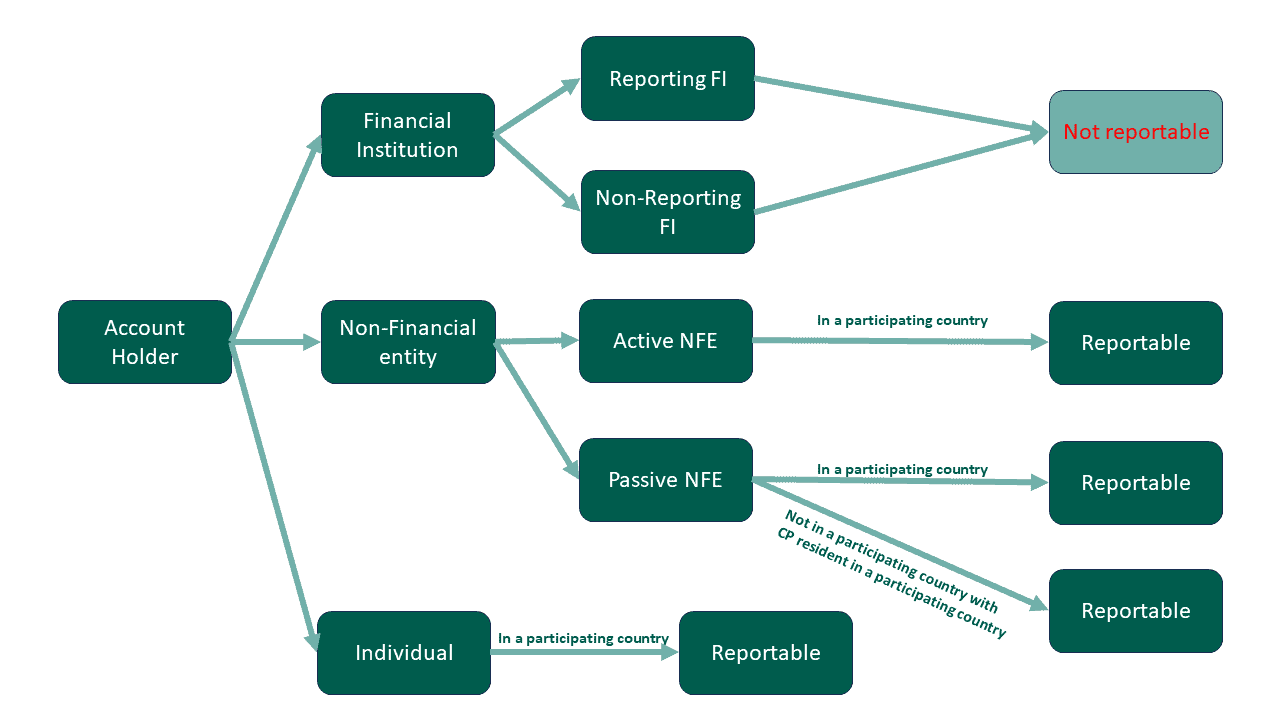

Which CRS account holders should be reported?

What should be reported?

- Financial Institution Information: This includes the name, address, and tax identification number of the financial institution holding the account.

- Account Holder Information: This includes the name, address, tax identification number (TIN), date of birth, and country of tax residence of the account holder.

- Account Information: This includes the account number, type of account, and the balance or value of the account.

- Income Information: This includes details of interest, dividends, and other income generated by the account.

- Controlling person: This includes the name, address, tax identification number (TIN), date of birth, and country of tax residence of the controlling person.

What is the consequence of incorrect or delayed submission of CRS reports?

In the event of either a complete failure to submit a report or a delayed filing of a NIL return, these institutions may be held accountable for a fixed fine of EUR 10,000. However, Luxembourg reporting financial institutions have the opportunity to present justifications, such as a change in legal status, to the ACD before this fixed fine is enforced.

Additionally, these reporting financial institutions could face fines of up to EUR 250,000 if, following an audit by the ACD, it is determined that they have not fulfilled their obligations as required.

Which countries are participating jurisdictions for CRS?

- 2016:

- South Africa, Germany, Argentina, Austria, Barbados, Belgium, Bulgaria, Cyprus, Colombia, Korea, Croatia, Curacao, Denmark, Spain, Estonia, Finland, France, Gibraltar, Greece, Greenland, Guernsey, Hungary, Isle of Man, Faroe Islands, India, Ireland, Iceland, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Malta, Mexico, Montserrat, Niue, Norway, Netherlands, Poland, Portugal, Slovak Republic, Czech Republic, Romania, United Kingdom, San Marino, Seychelles, Slovenia, Sweden.

- 2017:

- Andorra, Antigua and Barbuda, Saudi Arabia, Aruba, Australia, Azerbaijan, Belize, Brazil, Canada, Chile, China, Costa Rica, Ghana, Pomegranate, Hong Kong, Cook Islands, Indonesia, Israel, Japan, Lebanon, Macau, Malaysia, Mauritius, Monaco, New Zealand, Pakistan, Panama, Russia, Saint Kitts and Nevis, Saint Lucia, St. Martin, Saint Vincent and the Grenadines, Samoa, Singapore, Switzerland, Türkiye, Uruguay, Vanuatu.

- 2018

- Nigeria.

- 2019

- Albania, Dominica, Ecuador, Kazakhstan, Liberia, Oman.

- 2020

- Brunei Darussalam, Morocco, New Caledonia, Peru.

- 2021

- Kenya, Maldives.

- 2022

- Jamaica, Moldova, Uganda, .

- 2023

- Jordan, Montenegro, Thailand