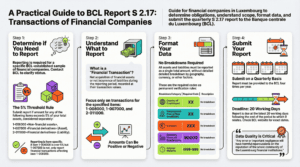

This briefing provides a comprehensive analysis of the Banque centrale du Luxembourg (BCL) statistical report S 2.17, “Transactions of financial companies.” The report is a quarterly data collection requirement for a select sample of financial companies, designed to provide the BCL and the European Central Bank (ECB) with information on transactions affecting specific balance sheet items.

Reporting is not universal; it is triggered only when certain asset or liability items—namely “Non-financial assets” and “Financial derivatives”—exceed 5% of a company’s total assets when considered separately. The BCL places extreme importance on the quality and accuracy of submitted data, noting that errors can have “harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.”

While the reporting template includes fields for detailed breakdowns by country, currency, and sector, the current instructions mandate that all transactions be reported as aggregated totals using specific codes. Compliance requires a rigorous understanding of the reporting thresholds, data definitions, and verification rules. Specialized solutions, are essential for automating this complex process, ensuring data integrity, and mitigating significant compliance and reputational risks.

Overview of BCL Report S 2.17

Objective and Scope

The primary objective of report S 2.17 is to gather statistical information on financial transactions that affect key balance sheet items for a sample of financial companies established by the BCL. “Financial transactions” are defined as the net acquisition of financial assets or the net incurrence of liabilities, recorded at their transaction value during the reporting period. This data is crucial for the BCL, as part of the Eurosystem, to monitor economic and financial activity.

Regulatory Authority

The report is mandated by the Banque centrale du Luxembourg (BCL). It is important to note that in all official documentation, any discrepancies between the English and French texts are resolved in favor of the French version, which “shall prevail.”

Reporting Obligations and Framework

Reporting Population

The obligation to submit report S 2.17 applies to a specific sample of financial companies designated by the BCL. The instructions stipulate that all companies that fall within the official definition of a “financial company” are required to contact the BCL to determine their status.

Frequency and Deadlines

The reporting cadence is quarterly. Submissions are due to the BCL at the latest 20 working days following the end of the quarter to which the report relates. The BCL publishes the exact reporting dates on its official website.

Reporting Threshold

Submission of the S 2.17 report is conditional. A financial company is only required to submit the report if any of the following balance sheet items, when considered separately, represent more than 5% of the company’s total assets:

- 1-006000: «Non-financial assets»

- 1-007000: «Financial derivatives» (Asset)

- 2-011000: «Financial derivatives» (Liability)

The BCL provides a clarifying example: if a company’s holdings under item 1-006000 exceed 5% of total assets and its holdings under 1-007000 also exceed 5%, the company is only required to report on the financial transactions affecting item 1-006000. Reporting for item 1-007000 in this specific scenario is described as “not compulsory.”

Data Requirements and Formatting

Although the S 2.17 template contains columns for detailed breakdowns, the accompanying instructions explicitly state that these breakdowns are not required. Instead, reporting agents must use specific codes to submit aggregated totals for the relevant balance sheet items.

The required formatting for all reportable lines is as follows:

|

Breakdown Category

|

Required Code

|

Description

|

|

Country

|

XX

|

No breakdown by country of the counterpart.

|

|

Geographical area of the final beneficiary

|

XX

|

No breakdown by geographical area.

|

|

Currency

|

XXX

|

No breakdown by the currency of denomination.

|

|

Economic sector

|

90000

|

No breakdown by the economic sector of the counterparty.

|

|

Original maturity

|

I999-999

|

No breakdown by original maturity.

|

Furthermore, the reported amount can be a positive or negative value, reflecting the net nature of the financial transactions during the period.

Data Quality and Verification

The BCL places a significant emphasis on the integrity of the data it collects. The “Compendium of verification rules for report S 2.17” serves as the primary technical documentation for ensuring the internal consistency of submissions.

Regulatory Scrutiny and Reputational Risk

The BCL explicitly warns of the consequences of poor data quality:

“This point is all the more important since the data collected will be checked by the ECB before aggregating it with the data of the other Member states. Any error or important negligence will have harmful repercussions on the reputation of the whole community of the Luxembourg financial institutions.”

Permanent Verification Rules

The compendium outlines “permanent verification rules” that must be applied to every S 2.17 submission. These rules are designed to be implemented directly by software providers to ensure foundational compliance. The current permanent rules confirm that for all reportable lines (1-006000, 1-007000, and 2-011000), the specific “No breakdown” codes listed in the table above must be used.

Addressing Reporting Challenges with the Fund XP Solution

The complexity, strict deadlines, and high data quality standards of BCL Report S 2.17 present significant operational and compliance challenges for financial companies. The Fund XP solution is designed to directly address these pain points.

- Automated Compliance and Accuracy: The Fund XP platform can automate the process of identifying whether the 5% reporting threshold has been met for the relevant balance sheet items. By embedding the BCL’s permanent verification rules, the solution ensures that all generated reports are correctly formatted with the required XX, XXX, 90000, and I999-999 codes, eliminating common sources of manual error.

- Enhanced Data Integrity: By providing a structured and controlled environment for data aggregation and report generation, Fund XP helps firms meet the rigorous quality requirements of the BCL and ECB. This systematic approach is critical for protecting the firm’s reputation and avoiding the negative repercussions highlighted by the regulator.

- Operational Efficiency: The solution streamlines the entire reporting workflow, from data extraction to final submission. Automating these steps significantly reduces the manual effort required and ensures that the stringent 20-working-day deadline can be met consistently and without compromising on quality, allowing compliance teams to focus on analysis rather than manual data preparation.

Discover our BCL solution : https://fund-xp.lu/excel-to-bcl-reporting/

BCL website : https://www.bcl.lu/en/Regulatory-reporting/Societes_financieres/Instructions/S0217/index.html