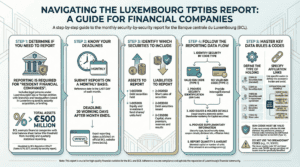

The Banque centrale du Luxembourg (BCL) mandates a rigorous monthly security-by-security reporting requirement for financial companies, known as TPTIBS («Monthly security by security reporting of financial companies»). This detailed data collection applies to all resident financial entities in Luxembourg with a total balance sheet exceeding €500 million. The report demands granular data on both asset and liability security holdings, with distinct and complex requirements for instruments with and without an ISIN code.

Data quality is paramount, as the BCL emphasizes that submissions are double-checked by the European Central Bank (ECB) and that “any error or important negligence will have harmful repercussions on the reputation of the whole financial community in Luxembourg.” Reporting agents must navigate a complex web of specific codes for affiliation links, holding types, issuer sectors, and security characteristics, alongside a comprehensive set of permanent verification rules. Failure to adhere to these standards can lead to reporting delays and reputational damage. Effectively managing this process requires robust data aggregation, stringent validation, and a deep understanding of the nuanced reporting instructions.

1. Overview of the TPTIBS Reporting Mandate

The TPTIBS report is a key statistical collection framework established by the Banque centrale du Luxembourg (BCL) under Regulation 2014/17. Its primary purpose is to gather highly detailed, security-level data from financial companies operating in Luxembourg. This compendium outlines the scope, requirements, and critical complexities of the TPTIBS framework.

The BCL explicitly states the importance of precision and adherence to its guidelines: “Only rigorous control during the entire data production cycle will enable respecting the quality requirements as well as reporting delays.” The data collected is aggregated by the ECB with submissions from other Member States, placing Luxembourg’s financial community under a microscope and heightening the need for accuracy.

1.1. Reporting Population and Scope

The mandate applies to “resident financial companies” whose total assets surpass a specific threshold.

- Reporting Threshold: The requirement is triggered for companies with a total balance sheet of €500 million or its equivalent in foreign currency. The BCL exempts entities below this threshold.

- Definition of a Financial Company: A company is considered financial if its objectives include activities such as:

- Investing in any society for any kind of investment.

- Acquiring securities, bonds, receivables, and other financial instruments.

- Investing in and managing real estate portfolios, patents, or intellectual property.

- Borrowing in any form or lending funds to shareholders, subsidiaries, or affiliated companies.

- Definition of a Resident Company: The rule applies to legal persons under Luxembourgish law (for all activities of head offices and branches in Luxembourg) and legal persons under foreign law (for all activities performed by branches and headquarters based in Luxembourg).

1.2. Frequency and Deadlines

Reporting is conducted on a strict timeline:

- Frequency: Monthly.

- Reference Date: The last day of each month.

- Submission Deadline: At the latest, 20 working days following the end of the reporting period. Exact dates are published on the BCL website.

2. Core Reporting Components and Balance Sheet Items

The TPTIBS report requires a granular breakdown of specific asset and liability positions as they would appear on the quarterly statistical balance sheet S 2.16. For each security, a balance sheet line must be identified, composed of an item code, a country code (must be “XX”), a currency code (must be “XXX”), and an economic sector code (must be “90000”).

The following balance sheet items are subject to security-by-security reporting:

|

Side

|

Item Code

|

Description

|

|

Assets

|

1-003000

|

Debt securities held

|

|

Assets

|

1-005000

|

Equity and investment fund shares/units held

|

|

Liabilities

|

2-002050

|

Short sales of securities

|

|

Liabilities

|

2-003000

|

Debt securities issued

|

|

Liabilities

|

2-C05000

|

Capital, share premium, reserves and results

|

3. Data Identification: ISIN vs. Non-ISIN Securities

A fundamental distinction in TPTIBS reporting is whether a security possesses a valid ISIN code. The level of supplementary detail required increases significantly for securities without one.

- Securities with ISIN (Code Type “1”): The security must be identified by its ISIN code, which must satisfy the ISO 6166 standard. Provisional, pseudo, or internal codes mimicking the ISIN format are explicitly disallowed and must be reported as non-ISIN securities.

- Securities without ISIN (Code Type “2”): When no valid ISIN exists, an internal or external code (e.g., CUSIP, SEDOL) must be used. For Luxembourg-resident issuers, the Registre de commerce identification number (e.g., B1234) must be used. These securities require extensive supplementary information, including issuer country and sector, security name, currency, and detailed instrument characteristics.

4. Key Data Concepts and Required Fields

Successful TPTIBS reporting hinges on the correct application of several complex concepts and the accurate population of numerous data fields.

4.1. Identification of Issuer and Shareholder

For non-ISIN securities, detailed identification of the issuer is mandatory.

- Issuer Country: Must conform to ISO 3166 codification. The use of code “XX” (No breakdown) is not permitted.

- Issuer Sector: Must align with the BCL’s established list of economic sectors. The use of code “90000” (No breakdown) is not permitted.

For liabilities under item 2-C05000, the country of residence of the direct shareholder must also be identified.

4.2. Affiliation Links

Reporting entities must specify the affiliation link between themselves and the counterparty for equity holdings and issuances. This requires a detailed understanding of the group structure.

|

Scope

|

Code

|

Description

|

|

Assets

|

01

|

Equity/fund shares held at ≥10% of capital (subsidiary/branch).

|

|

Assets

|

02 |

Equity/fund shares held at <10% issued by the reporting entity’s shareholder (cross-holding).

|

|

Assets

|

U1-U4

|

Equity/fund shares held at <10% issued by a sister company, broken down by parent company location (LU, EZ, EU, non-EU).

|

|

Assets

|

03 |

Equity/fund shares held at <10% issued by a non-group company (no affiliation).

|

|

Liabilities

|

04

|

Equity/fund shares issued and held at ≥10% by a shareholder.

|

|

Liabilities

|

05 |

Equity/fund shares issued and held at <10% by a company where the reporter holds >10% (cross-holding).

|

|

Liabilities

|

V1-V4

|

Equity/fund shares held at <10% by a sister company, broken down by parent company location (LU, EZ, EU, non-EU).

|

|

Liabilities

|

06

|

Equity/fund shares issued and held at <10% by a non-group company (no affiliation).

|

4.3. Type of Securities Holdings

The concept of the “economic holder” is applied. A company that has lent securities or sold them via a repurchase agreement is still considered the holder.

|

Code

|

Type of Holding

|

|

01

|

Securities held and not affected by a temporary transfer

|

|

02

|

Securities lent

|

|

03

|

Securities sold in a repurchase agreement

|

|

04

|

Securities issued

|

|

05

|

Short sales of securities

|

Note: Securities borrowed or received in a repurchase agreement are not reported.

4.4. Supplementary Information for Non-ISIN Securities

For each non-ISIN security, a host of supplementary data points must be provided, categorized by instrument type.

For Debt Securities (Held or Issued):

- Security Type: Must be “F.3”.

- Dates: issueDate, finalMaturityDate (use 01.01.2999 for perpetuals).

- Pool Factor: Represents the percentage of principal remaining. Default is “1” if not applicable.

- • Coupon Data: Includes couponType (fixed, floating, etc.), couponFrequency, couponLastPaymentDate, and couponRate (annualized percentage).

For Equity and Investment Fund Shares/Units (Held):

- Security Type: Coded as F.511 (Quoted), F.512 (Unquoted), F.519 (Other equity), or F.52 (Fund shares/units).

- • Dividend Data: Includes dividendAmount (reported as a coefficient) and dividendLastPaymentDate.

For Capital, Share Premiums, Reserves (Issued):

- Security Type: Coded as F.511 (Quoted), F.512 (Unquoted), or F5.19 (Other equity).

- Dividend Data: Same as for held equity.

- Holder Identification: Requires shareholderCountry and relationLink.

5. Data Quality and BCL Verification Rules

The BCL performs rigorous consistency checks and has published a “Compendium of verification rules” that reporting agents and their software providers are expected to implement. These are divided into permanent and temporary rules.

Key Permanent Verification Rules Include:

-

- Authorized Items: Only the specified balance sheet items are permitted.

- Amount Logic: For items 1-003000, 2-002050, and 2-003000, the reportedAmount must be greater than or equal to 0.

- Quantity Validation: If reportedAmount is > 0, then nominalAmount (for percentage-quoted) or numberOfUnits (for currency-quoted) must also be > 0.

- ISIN Validation: ISIN codes must pass the key check and conform to ISO 6166, with valid country prefixes.

- Code Validity: Country and sector codes for issuers must be from the BCL’s authorized lists and cannot be generic “no breakdown” codes.

6. Addressing TPTIBS Complexity with the Fund XP Solution

The depth, granularity, and stringency of the TPTIBS reporting framework present a significant operational challenge. The combination of monthly deadlines, complex affiliation logic, and severe penalties for poor data quality necessitates a strategic, technology-driven approach.

The Fund XP solution is designed to directly address these challenges and streamline the BCL reporting process for financial companies.

- Automated Data Aggregation: Fund XP can centralize security-level data from multiple internal systems (portfolio management, accounting, custody) into a single source of truth for reporting.

- Pre-submission Validation: By embedding the BCL’s “permanent verification rules,” the solution acts as a critical quality gate. It can automatically flag invalid ISINs, incorrect sector codes, logical inconsistencies between amounts and quantities, and other common errors before the file is submitted, preventing rejections and inquiries from the BCL.

- Complex Logic Management: The platform is engineered to manage the nuanced requirements for non-ISIN securities, automatically prompting for and structuring the necessary supplementary information. It can also be configured to map and apply the correct affiliation link codes based on the entity’s corporate structure.

- Compliance and Accuracy: Fund XP ensures that the final report is generated in the precise format required by the BCL, with all data fields correctly populated. This minimizes manual effort, reduces the risk of human error, and ensures adherence to the reporting deadline.

- Reputational Risk Mitigation: By ensuring the delivery of high-quality, accurate, and timely data, the Fund XP solution helps financial institutions meet the BCL’s high standards, thereby safeguarding their reputation within the Luxembourg financial community and with the ECB.

Discover our solution: https://fund-xp.lu/excel-to-bcl-reporting/

BCL website : https://www.bcl.lu/en/Regulatory-reporting/Societes_financieres/Instructions/TPTIBS/index.html