Features

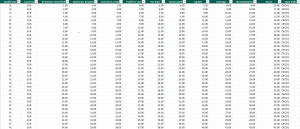

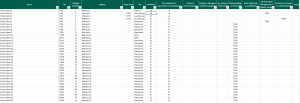

Our CBCR (Country By Country Reporting) XML reporting solution leverages user-friendly Excel templates, making it easy for financial and tax professionals to input relevant data directly into familiar spreadsheets.

Our templates guide users through the data entry process, minimizing errors and streamlining reporting tasks.

We build your Country By Country Reporting using complete automatic processes and automated validation checks. We stay up-to-date with the latest specifications, ensuring that our software reflects any changes or updates. This way, your reports are always compliant with the current regulatory standards.

Optionnaly, we can do the filing to the Luxemburgish authority (ACD).

-

SCALABILITY AND FLEXIBILITY

Tailor your CBCR XML reports to meet your organization’s specific needs and preferences. Our solution allows for extensive customization within the Excel templates, enabling you to adjust structures, add supplementary information, and format data according to your requirements.

-

ACCURACY

Robust controls in place to prevent errors or omissions.

-

TIMELINESS

Our fully automatic solution enables entities to meet the required reporting deadlines.

-

USER FRIENDLY

The solution is easy for users to understand and use, with clear instructions and intuitive interfaces.

-

SUPPORT

From template customization to troubleshooting assistance, our dedicated support team is here to help every step of the way. Benefit from personalized guidance and expertise as you navigate Luxembourg’s CBCR reporting requirements with confidence.

What is CbCR reporting?

What should be reported?

- Revenue and Profit:

- Total revenue generated by the MNE in each jurisdiction.

- Profit or loss before income tax.

- Income Tax Paid and Accrued:

- Total income tax paid on a cash basis.

- Total income tax accrued, which may include provisions for future tax liabilities.

- Stated Capital:

- The amount of stated capital in each jurisdiction.

- Accumulated Earnings:

- The net amount of earnings retained in each jurisdiction.

- Number of Employees:

- The total number of employees on a full-time equivalent basis in each jurisdiction.

- Tangible Assets:

- The value of tangible assets other than cash or cash equivalents in each jurisdiction.

- Nature of Business Activities:

- A brief description of the main business activities conducted in each jurisdiction.

It’s important to note that the specific requirements for CBCR may vary by jurisdiction, as each country may have its own regulations and guidelines. The OECD has developed a model template for CBCR, and many countries have adopted similar reporting standards based on the OECD’s recommendations. MNEs need to comply with the reporting requirements of each jurisdiction in which they operate to ensure transparency and compliance with international tax standards.

Which countries are participating jurisdictions for CbCR?

This link provides all bilateral exchange relationships that are currently in place for the automatic exchange of CbC reports between tax authorities:

https://www.oecd.org/tax/beps/country-by-country-exchange-relationships.htm