Submit your DORA ROI correctly: FiMiS platform guide, xBRL-CSV format requirements, validation feedback, and correction process.

Read More

Insights

Latest news and insights from Fund XP

CAA DORA Register Of Information Solution

Learn about Luxembourg's CAA circular LC 25/1 on DORA compliance and the DORA Register.

Read More

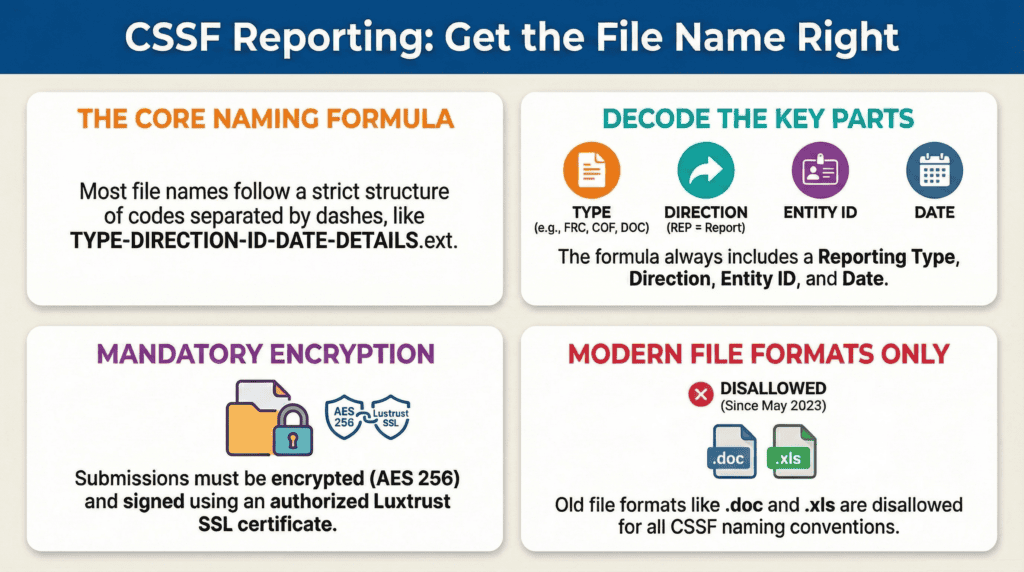

CSSF File Naming Conventions for Electronic Reporting

Master CSSF file naming conventions for electronic reporting: Learn the exact formats for COF, DOC, EDP, EME, ESP, FRC, OPC,...

Read More

TPT Luxembourg: BCL Security-by-Security Reporting

Complete guide to TPT Luxembourg security-by-security reporting for BCL compliance. Learn TPTOBS, TPTIBS, and TPTTBS requirements, validation rules, and critical...

Read More

BCL Report S 1.6: Valuation Effects for Funds

BCL Report S 1.6 explained: Learn valuation effects reporting requirements for Luxembourg investment funds. Understand the 5% threshold, calculation methodology,...

Read More

BCL Reporting: S 1.3 and S 2.13 Requirements

BCL S 1.3 and S 2.13 reporting guide: Master monthly and quarterly statistical balance sheet requirements for Luxembourg investment funds....

Read More

BCL TPTOBS Reporting Requirements

BCL TPTOBS reporting explained: Complete guide to Luxembourg security-by-security reporting requirements for investment funds. Learn ISIN vs non-ISIN data rules,...

Read More

BCL Statistical Reporting for Investment Funds

Complete BCL statistical reporting guide for Luxembourg investment funds: Navigate S 1.3, S 2.13, TPTOBS, S 1.6, and S 2.20...

Read More

BCL Reporting for Luxembourg Securitisation Vehicles

BCL reporting for Luxembourg securitisation vehicles: Master TPTTBS, S 2.14, and S 2.15 requirements. Learn monthly security-by-security reporting, quarterly balance...

Read More

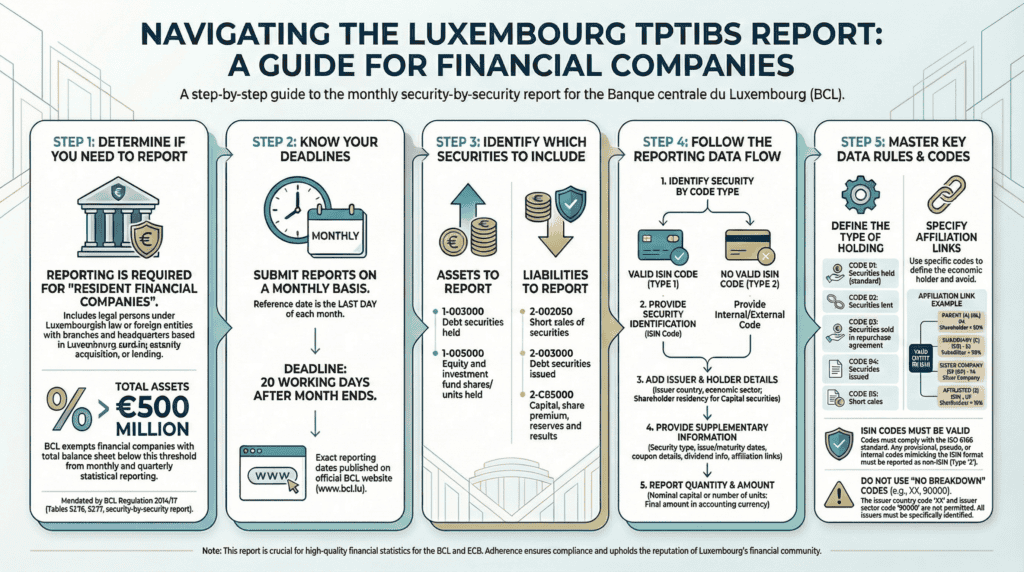

BCL Statistical Reporting for Financial Companies

BCL reporting for Luxembourg financial companies: Master TPTIBS, S 2.16, and S 2.17 requirements. Learn monthly security-by-security reporting, affiliation links,...

Read More

BCL S 2.14 Reporting: A Comprehensive Briefing

BCL S 2.14 reporting guide for securitisation vehicles: Master quarterly balance sheet requirements including country, currency, sector, and maturity breakdowns....

Read More

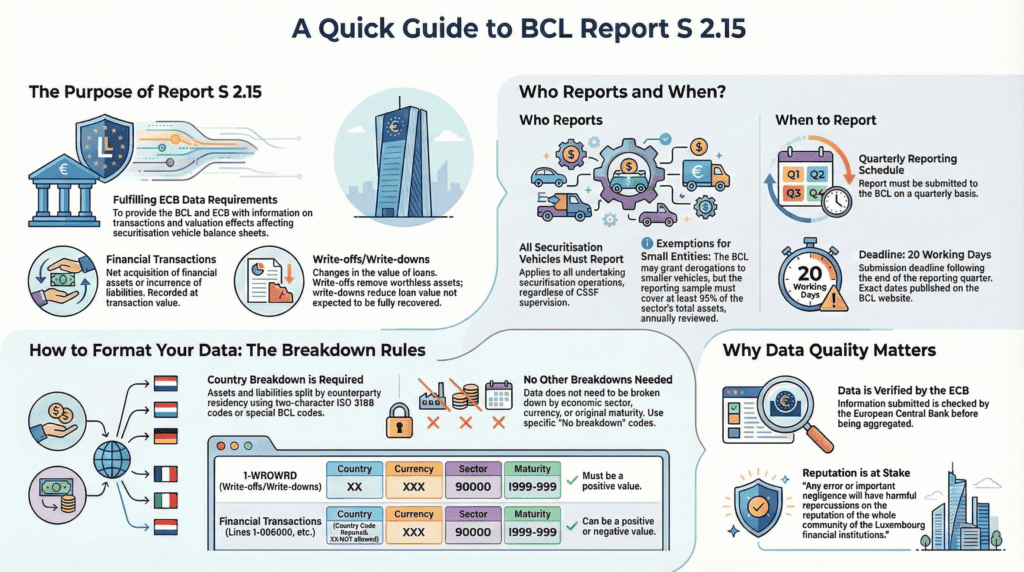

BCL S 2.15 Report for Securitisation Vehicles

BCL S 2.15 quarterly reporting for securitisation vehicles: Learn financial transaction tracking and write-off/write-down requirements for securitised loans. Master country...

Read More

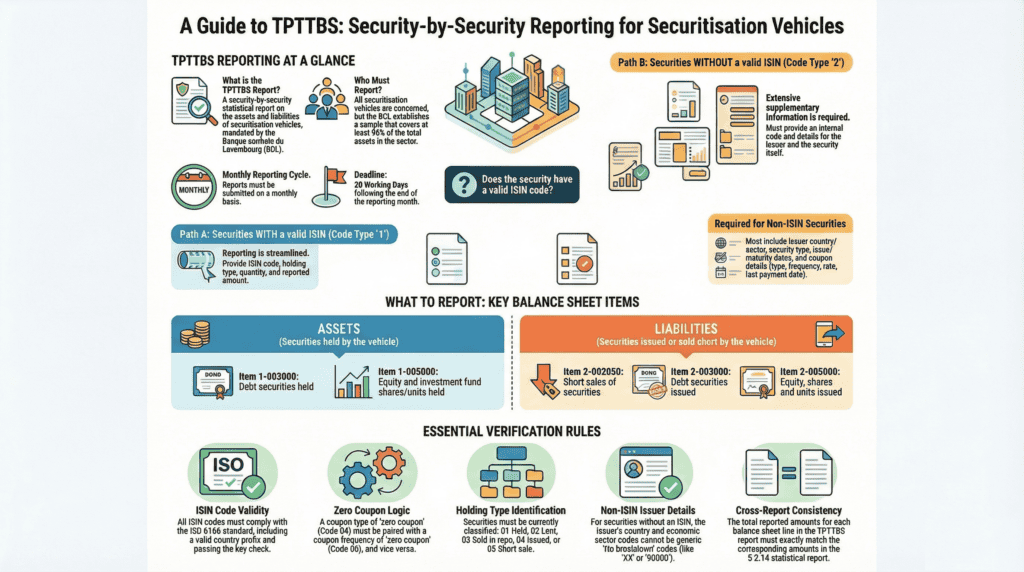

BCL TPTTBS Reporting for Securitisation Vehicles

BCL TPTTBS monthly reporting for securitisation vehicles: Master security-by-security requirements including ISIN vs non-ISIN data rules, validation checks, supplementary information...

Read More

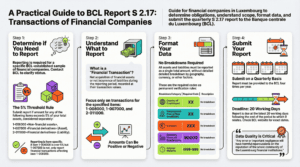

BCL S 2.17: Financial Company Transactions

BCL S 2.17 quarterly reporting for financial companies: Learn transaction reporting requirements triggered when non-financial assets or derivatives exceed 5%...

Read More

CSSF: General information in relation to the annual review of PRIIP-KIDs (UCITS)

General Information Regarding the Annual Review of PRIIP Kids UCITS The Commission de Surveillance du Secteur Financier (CSSF) has released...

Read More

CSSF: Publication of three new questions and answers provided by the European Commission on investment-management-related queries

European Commission publishes three new Q&As on investment management: Learn about updated guidance on investment strategies, risk management practices, and...

Read More

CSSF: Shortening Settlement Cycle in the EU

Shortening the Settlement Cycle in the EU: A Step Towards Efficiency The European Union is taking significant steps to enhance...

Read More

CSSF: High-level Roadmap to T+1 Securities Settlement in the EU and related call for Feedback (until 31 August 2025)

High-Level Roadmap to T1 Securities Settlement in the EU The Commission de Surveillance du Secteur Financier (CSSF) has released a...

Read More

CSSF: Countdown to halving settlement times on financial markets – European survey on T+1

Countdown to Halving Settlement Times on Financial Markets: Insights from the European Survey on T+1 The financial landscape in Europe...

Read More

CSSF: Circular CSSF 22/811 (as amended by Circular CSSF 25/900) (Updated)

Understanding Circular CSSF 22/811: Key Insights The Commission de Surveillance du Secteur Financier (CSSF) has issued Circular CSSF 22/811, which...

Read More