High-Level Roadmap to T1 Securities Settlement in the EU The Commission de Surveillance du Secteur Financier (CSSF) has released a...

Read More

Insights

Latest news and insights from Fund XP

CSSF: Countdown to halving settlement times on financial markets – European survey on T+1

Countdown to Halving Settlement Times on Financial Markets: Insights from the European Survey on T+1 The financial landscape in Europe...

Read More

CSSF: Circular CSSF 22/811 (as amended by Circular CSSF 25/900) (Updated)

Understanding Circular CSSF 22/811: Key Insights The Commission de Surveillance du Secteur Financier (CSSF) has issued Circular CSSF 22/811, which...

Read More

CSSF: Circular IML 91/75 (as amended by Circulars CSSF 05/177, 18/697, 21/790, 22/811 and 25/901) (Updated)

Understanding Circular IML 91/75: Key Insights The Circular IML 91/75 issued by the Commission de Surveillance du Secteur Financier (CSSF)...

Read More

CSSF: MMF Reporting dashboard – December 2024

MMF Reporting Dashboard - December 2024 The Monetary Market Fund (MMF) Reporting Dashboard for December 2024 provides valuable insights into...

Read More

CSSF: UCITS V – Practical issues in relation to the UCITS V regime and depositary aspects in relation to Part II UCIs

Understanding UCITS V: Practical Issues and Depositary Aspects The UCITS V directive represents a significant evolution in the regulatory framework...

Read More

CSSF: Commission Delegated Regulation (EU) 2019/1866 of 3 July 2019

Understanding the Commission Delegated Regulation (EU) 2019/1866 The Commission Delegated Regulation (EU) 2019/1866, adopted on July 3, 2019, plays a...

Read More

CSSF: Active account notification under Article 7a(1) of EMIR

Understanding Active Account Notification Under Article 7a(1) of EMIR The European Market Infrastructure Regulation (EMIR) plays a crucial role in...

Read More

CSSF: Communication regarding the update of the eDesk procedure: AML/CFT Market Entry Form (Funds and IFMs)

Update on the eDesk Procedure for AML/CFT Market Entry Form for Funds and IFMs The Commission de Surveillance du Secteur...

Read More

CSSF: FAQ – Circular CSSF 25/894 (Updated)

Understanding the CSSF Circular 25/894 The Commission de Surveillance du Secteur Financier (CSSF) has issued Circular 25/894 to provide clarity...

Read More

CSSF: IMMV Form (Updated)

Understanding the IMM-V Form: A Comprehensive Guide The IMM-V form is a crucial document for individuals and entities involved in...

Read More

CSSF: ESMA communication on upcoming reporting obligations under EMIR 3

ESMA Communication on Upcoming Reporting Obligations Under EMIR 3 The European Securities and Markets Authority (ESMA) has recently issued a...

Read More

CSSF: Form for cease of AIF management (Updated)

Understanding the Cease of AIF Management In the world of Alternative Investment Funds (AIFs), the decision to cease management activities...

Read More

CSSF: Initial/update form AIF with multiple compartments (Updated)

Initial Update Form for AIFs with Multiple Compartments The Commission de Surveillance du Secteur Financier (CSSF) has provided important guidelines...

Read More

CSSF: Initial/update form AIF without compartments (Updated)

Initial Update Form for AIFs Without Compartments The Commission de Surveillance du Secteur Financier (CSSF) has provided an essential update...

Read More

CSSF: Compilation of key concepts and terms used in the field area of investment funds other than UCITS and MMFs and explanations on how the CSSF defines understands them

Understanding Key Concepts in Investment Funds In the realm of investment funds, particularly those that fall outside the categories of...

Read More

Investment funds: Circular CSSF 25/901

Circular 25/901 represents a significant effort to modernize, clarify, and simplify the regulatory framework for specific Luxembourg investment funds

Read More

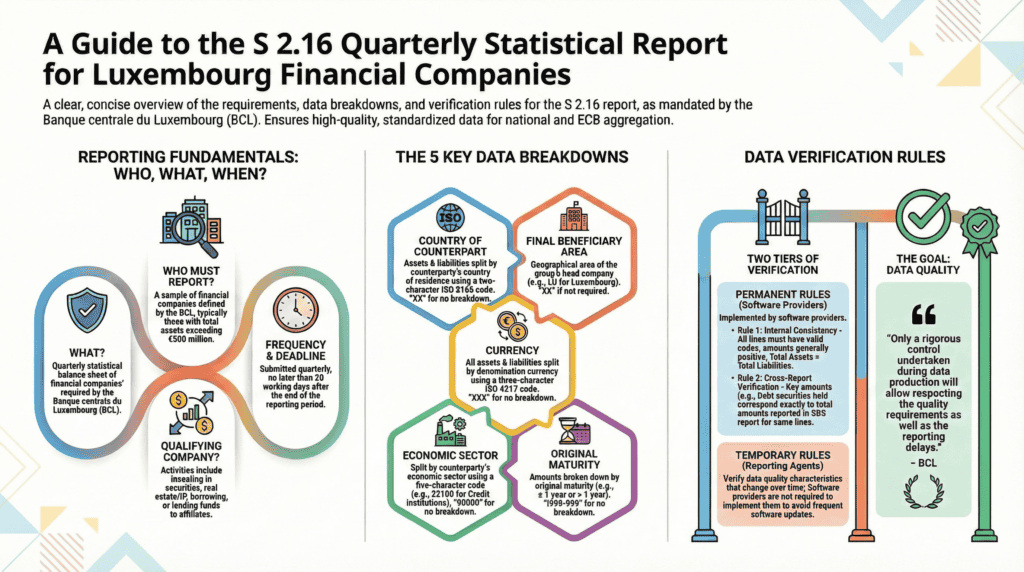

BCL S 2.16 Reporting for Financial Companies

BCL S 2.16 quarterly balance sheet reporting for Luxembourg financial companies. Criterias breakdowns, SBS validation, and compliance guide.

Read More

BCL TPTIBS: Reporting for Financial Companies

BCL TPTIBS monthly security-by-security reporting guide for Luxembourg financial companies. Deadlines and compliance standards.

Read More

BCL 2026 Calendar for Reporting of Credit Institutions

The following tables present the complete official remittance dates for statistical reporting obligations in 2026. These deadlines apply to credit...

Read More